Bracket Orders

Bracket orders are designed to help limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order.

The order quantity for the high and low side bracket orders matches the original order quantity. By default, the bracket order is offset from the current price by 1.0. This offset amount can be changed on the order line for a specific order, or modified at the default level for an instrument, contract or strategy using the Order Presets feature in Global Configuration.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| CFDs | US Products | Smart | Attribute | ||||

| Combos | Non-US Products | Directed | Order Type | ||||

| EFPs | Time in Force | ||||||

| FOPs | Attached Order | ||||||

| Forex | |||||||

| Futures | |||||||

| Options | |||||||

| Stocks | |||||||

| Warrants | |||||||

| Open Users' Guide | |||||||

Bracket Orders in Mosaic Short Video

Your capital is at risk.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority.

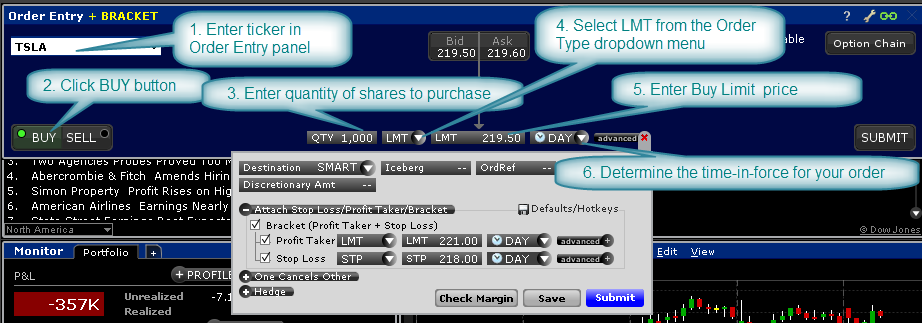

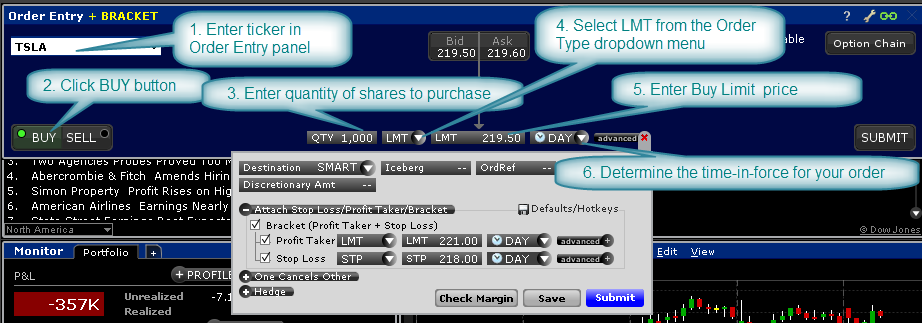

Mosaic Example

In this example, we wish to buy 1,000 shares in ticker TSLA at a price of no more than $219.50. However, at the same time we want to determine a Stop Loss order to sell the shares should the price drop to $218.00. We also wish to place a Profit Taking order in the event that TSLA rises to $221.00 during the session. Enter the desired ticker and click the Buy button, which causes the background to turn blue. Sell orders create a red background. Enter the number of shares to be purchased and select LMT from the Order Type dropdown menu. Next set your limit price at which you are prepared to buy shares. Change the TIF field if required. Users may select the Time-in-Force field to select a Good-til-Cancelled duration for the trade. In this example, we are using a Day order.

Assumptions

| Limit Buy Order | |

| Action | BUY |

| Qty | 1,000 |

| Order Type | LMT |

| Market Price | 219.60 |

| Limit Price | 219.50 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 1,000 |

| Order Type | LMT |

| Market Price | 219.60 |

| Limit Price | 221.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 1,000 |

| Order Type | STP |

| Market Price | 219.60 |

| Limit Price | 218.00 |

Next, click on the Advanced button to the right of the TIF field to display more order entry options. Click on the Attach button to the right to reveal Bracket functionality. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked. Enter the desired values for the Profit Taker Limit order. And enter the desired Stop Limit sell order price. Once again, users may change the TIF if necessary before clicking the Submit button to enter the completed order.

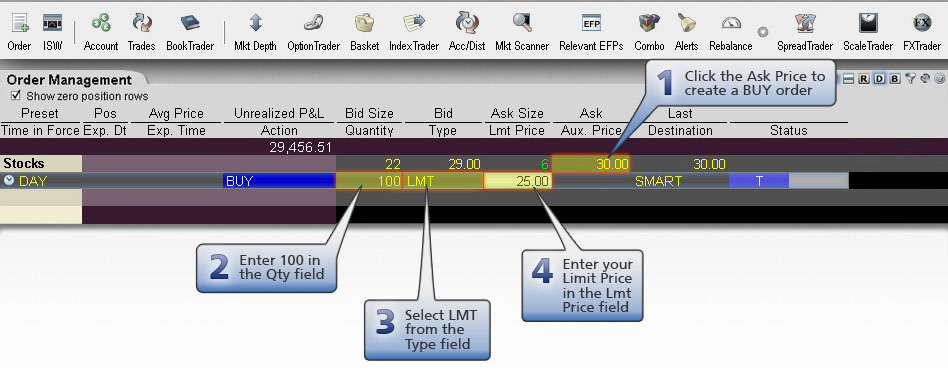

Classic TWS Example

Order Type In Depth - Bracket Order

Step 1 – Enter a Limit Buy Order

Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. In this example, you want to buy 100 shares of XYZ stock, which has a current Ask price of 30.00. You expect the price to fall to 25.00, then rise to 30.00. By attaching a bracket order, you do not have to return to reevaluate and manage the risk of a position if the Limit order to buy at 25.00 per share is executed.

You click the Ask price of XYZ stock to create a Buy order, then enter the quantity and order type, then enter 25.00 as your Limit price. You do not transmit the order yet because you want to attach a Bracket order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 30.00 |

| Limit Price | 25.00 |

Step 2 – Attach a Bracket Order

To attach a Bracket order to your Limit Buy order, right click the order row, then select Attach > Bracket Order. A Limit Sell and a Stop Sell order now bracket your original order. You enter 30.00 as the Limit price for the attached Limit Sell order, then you enter 20.00 in the Aux. Price field as the trigger price for the attached Stop Sell order. You transmit the order.

| Assumptions | |

|---|---|

| Market Price | 30.00 |

| Limit Buy Order | |

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 25.00 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 30.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | STP |

| Trigger Price | 20.00 |

Step 3 – Bracket Order Transmitted

You've transmitted your Bracket order. The diagram above illustrates the Market Price, the Limit Prices for your original Limit Buy order and the attached Limit Sell order and the Trigger Price for the attached Stop Sell order.

| Assumptions | |

|---|---|

| Market Price | 30.00 |

| Limit Buy Order | |

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 25.00 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 30.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | STP |

| Trigger Price | 20.00 |

Step 4 – Market Price Falls, Original Limit Buy Order Fills

As you expected, the price of XYZ shares falls to 25.00, which is the Limit Price for your original Limit Buy order. The order for 100 shares fills at that price. Your two Sell orders now enter the market.

| Assumptions | |

|---|---|

| Market Price | 25.00 |

| Limit Buy Order | |

| Limit Price | 25.00 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 30.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | STP |

| Trigger Price | 20.00 |

Step 5A – Market Price Rises, Limit Sell Order Fills

In one possible scenario, the price of XYZ rises to 30.00, which is the Limit Price of your attached Limit Sell order. The order fills at that price and you make $500.00 profit. The other attached order, the Stop Sell order, is canceled.

| Assumptions | |

|---|---|

| Market Price | 30.00 |

| Limit Buy Order | |

| Filled at | 25.00 |

| Limit Sell Order | |

| Limit Price | 30.00 |

| Stop Sell Order is canceled | |

Step 5B – Alternate Scenario: Market Price Falls, Stop Sell Order Fills

In an alternate scenario, the price of XYZ falls to 20.00, which is the Trigger Price of your attached Stop Sell order. A Market order executes at that price and you lose $500.00. The other attached order, the Limit Sell order, is canceled.

| Assumptions | |

|---|---|

| Market Price | 20.00 |

| Limit Buy Order | |

| Filled at | 25.00 |

| Stop Sell Order | |

| Trigger Price | 20.00 |

| Limit Sell Order is canceled | |