Adjustable Stop Orders

You can attach one-time adjustments to stop, stop limit, trailing stop and trailing stop limit orders. When you attach an adjusted order, you set a trigger price that triggers a modification of the original (or parent) order, instead of triggering order transmission.

Note that you can adjust any of the parent stop order types to any other stop order type; for example if you set up a Stop Limit, you can attach the one-time adjustment to change the order to a Trailing Stop, or if you start with a Stop order the adjustment can change it to a Trailing Stop Limit order.

In the example below, we show you how to attach an Adjusted Stop Limit order to a Stop order. You can attach adjusted orders using the Order Ticket or by customizing the fields on your trading window. In this example, we use the TWS Order Ticket.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| EFPs |  |

US Products |  |

Smart |  |

Attribute |  |

| Forex |  |

Non-US Products |  |

Directed |  |

Order Type |  |

| FOPs |  |

Time in Force |  |

||||

| Futures |  |

Attached |  |

||||

| Options |  |

||||||

| Stocks |  |

||||||

| Warrants |  |

||||||

| View Supported Exchanges|Open Users' Guide | |||||||

Example

Order Type In Depth - Adjustable Stop Sell Order

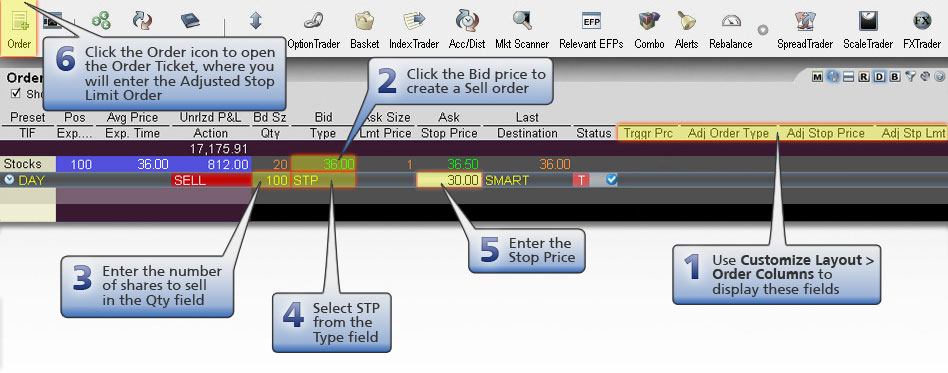

Step 1 – Enter a Stop Order

Here's the scenario: You're long 100 shares of XYZ stock at an Average Price of 36.00 (your entry price). You want to sell those 100 shares but you want to limit your loss to $600.00, so you create a Stop order with a Stop Price of 30.00. If the market price should rise however, you want to adjust your Stop Price to 37.00. You take advantage of the Adjustment feature in TWS to attach an Adjusted Stop Limit order. This will let you first limit your loss, then lock in a profit.

You click the Bid price of XYZ stock, then enter the inputs for the Stop Sell order as shown above.

| Assumptions | |

|---|---|

| Avg Price | 36.00|

| Market Price | 36.00 |

| Order Type | STP|

| Stop Price | 30.00 |

Step 2 – Attach an Adjusted Stop Limit Order

You set up your Adjusted Stop Limit order by entering values on the TWS Order Ticket as shown above.

| Assumptions | |

|---|---|

| Adjust to Order Type | STP LMT |

| Trigger Price | 40.00 |

| Adjusted Stop Price | 37.00 |

| Adjusted Stop Limit Price | 36.50 |

Step 3 – If the Market Price Falls, the Stop Order is Filled

Your adjusted Stop Sell order has been placed. The market price of XYZ is 36.00 and your Stop Price is 30.00. If the market price suddenly falls to the Stop Price, a Market order is submitted at that price. In this scenario, the attached Adjusted Stop Limit order is never used. See the Stop Orders page for more information on Stop orders.

| Assumptions | |

|---|---|

| Avg Price | 36.00 |

| Market Price | 36.00 |

| Order Type | STP |

| Stop Price | 30.00 |

| Stop Order adjusted to Stop Limit Order | |

| Trigger Price | 40.00 |

| Adjusted Stop Price | 37.00 |

| Adjusted Limit Price | 36.50 |

Step 4 – Market Price Rises to Trigger Price, Order Adjusted

However instead of falling, the market rises and with it, the market price of XYZ rises to 40.00, which is the Trigger Price for your adjusted order. The Stop order becomes a Stop Limit Order with an Adjusted Stop Price of 37.00 and an Adjusted Stop Limit Price of 36.50.

Now that the order has been adjusted to a Stop Limit order, if the market price of XYZ falls again and touches the Adjusted Stop Price of 37.00, a Limit order for 36.50 will be submitted.

| Assumptions | |

|---|---|

| Avg Price | 36.00 |

| Market Price | 40.00 |

| Order Type | STP |

| Stop Price | 30.00 |

| Stop Order adjusted to Stop Limit Order | |

| Trigger Price | 40.00 |

| Adjusted Stop Price | 37.00 |

| Adjusted Limit Price | 36.50 |

Step 5 – Market Price Falls to Adjusted Stop Price, Limit Order Submitted

The market continues to fall and the market price of XYZ falls to the Adjusted Stop Price of 37.00. A Limit order is automatically submitted with a Limit price of 36.50, which is your Adjusted Stop Limit Price.

| Assumptions | |

|---|---|

| Avg Price | 36.00 |

| Market Price | 37.00 |

| Adjusted Order Type | STP LMT |

| Trigger Price | 40.00 |

| Adjusted Stop Price | 37.00 |

| Adjusted Limit Price | 36.50 |

Step 6 – Market Price Falls to Adjusted Stop Limit Price, Order Filled

The market continues to fall and the market price of XYZ falls to the Adjusted Stop Price of 37.00. A Limit order is automatically submitted with a Limit price of 36.50, which is your Adjusted Stop Limit Price.

| Assumptions | |

|---|---|

| Avg Price | 36.00 |

| Market Price | 36.50 |

| Adjusted Order Type | STP LMT |

| Adjusted Stop Price | 37.00 |

| Adjusted Limit Price | 36.50 |