Market-to-Limit Orders

A Market-to-Limit (MTL) order is submitted as a market order to execute at the current best market price. If the order is only partially filled, the remainder of the order is canceled and re-submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| CFDs |  |

US Products |  |

Smart |  |

Attribute |  |

| EFPs |  |

Non-US Products |  |

Directed |  |

Order Type |  |

| Futures |  |

Time in Force |  |

||||

| FOPs |  |

||||||

| Options |  |

||||||

| Stocks |  |

||||||

| Warrants |  |

||||||

| View Supported Exchanges|Open Users' Guide | |||||||

Example

Order Type In Depth - Market-to-Limit Buy Order

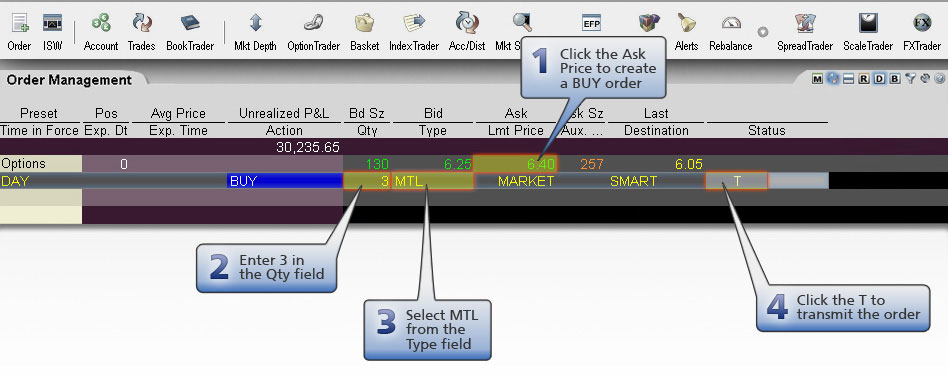

Step 1 – Enter a Market-to-Limit Order

The JAN11 130 XYZ call is currently trading at $6.25 - $6.40. You click the Ask price to create a buy order to buy three contracts, then select MTL in the Type field to make this a Market-to-Limit order. The word MARKET appears in the Lmt Price field to indicate that you are willing to buy at the current market price. You transmit the order.

A Market-to-Limit order executes as a market order at the current best price. If the order is only partially filled, the remainder is submitted as a Limit order with the Limit Price equal to the price at which the filled portion of the order executed.

Step 2 – Order Transmitted and Partially Filled as a Market Order

You've transmitted your Market-to-Limit order, and the order is partially filled as a Market order; you buy two contracts at $6.40, the best market price. The remainder of the order, one contract, is canceled and immediately re-submitted as a limit order with the Limit Price automatically set to $6.40. The Limit Price is the price at which the filled portion of the order executed.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 3 |

| Order Type | MTL |

| Market Price | 6.25 – 6.40 |

| Limit Price | MARKET (Current Market Price) |

Step 3 – The Remainder of the Order is Submitted as a Limit Order

The canceled portion of your order, a single contract for a JAN11 130 XYZ call, has been resubmitted as a Limit order with the Limit Price set to $6.40, which is the price at which the market order portion of the order was filled. The contract becomes available at the Limit Price, and the order is filled at that price, completing your entire order for three contracts.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1 (2 already filled) |

| Order Type | MTL |

| Market Price | 6.40 |

| Limit Price | 6.40 |