Beta Risk Fields

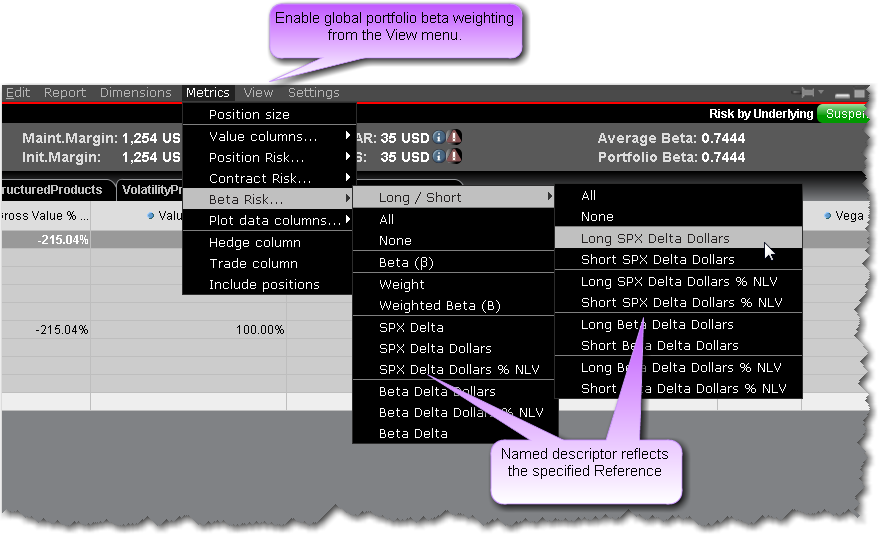

Add or remove beta risk-related fields using the Beta Risk section of the Metrics menu.

You can add one or multiple beta risk fields to your equity reports, but to enable beta weighting throughout the portfolio including the Risk Dashboard and P&L Graph, select Beta Weighted Portfolio from the View menu.

| 区域 | 描述 | 注释 |

|---|---|---|

| Long/Short | Shows the specific value for all long positions and for all short positions to allow you to see the aggregate for both. Note that the other field for these values provides the net. | |

| All | Add all Beta Risk fields. | |

| 无 | Remove all Beta Risk fields. | |

| 贝塔系数 (Beta) | The ultimate underlying’s raw beta at the ultimate underlying level (for reports with drill-down capability) and at the position level for stock positions. This means that for underlyings with both stock and option positions, the stock beta is displayed. Beta can be used to estimate the expected return on an asset given the return on a statistically related asset. | |

| Weight | The position weight used for the portfolio beta calculation (shown in the Risk Dashboard). | |

| Weighted Beta | The contribution of a given product to the total beta of your portfolio. | The total weighted beta value is also displayed in the "Portfolio Beta" field in the Risk Dashboard. |

| SPX (Beta Weighted) Delta |

The index-equivalent delta position for the stock. Calculation: Delta x dollar-adjusted beta (adjusted by ratio of close prices). |

The reference contract is displayed in the title of this field; this example uses SPX as the reference index. |

| SPX (Beta Weighted) Delta Dollars | This is a measure of the change in the position’s exposure in currency terms resulting from the change in the market (the reference contract). The Beta Weighted Delta Dollar reading multiplies the Delta * the position size to show the relative significance of any position translated in dollar terms and is the expected change in the value of the stock should the benchmark increase or decrease in value by $1.00 | |

| SPX (Beta Weighted) Delta Dollars % NLV | The ratio of the current beta weighted delta dollars to the portfolio's total net liquidity. | |

| Beta Delta Dollars | Exposure weighted by the unadjusted beta of the given position. For stocks, this is sometimes called the Beta-Adjusted Market Value. | |

| Beta Delta Dollars % NLV | Delta dollars weighted by the unadjusted beta of the given position as a percentage of the Total Net Liquidation/GMV of the entire portfolio. This is also referred to as the Beta-Adjusted Exposure or Beta-Adjusted Market Value in Percentage. | |

| Beta Delta | Beta-adjusted delta position, which is the delta position weighted by the unadjusted beta of the given position. |

You can also change the calculation used for all calculated fields from NLV to GMV. From the Settings menu select Percentage Column Calculations.

© 2016 Interactive Brokers - TWS用户指南