Continuous Futures

When adding futures market data to TWS, you can now select a "continuous" futures contract, which is a series of monthly/quarterly contracts spliced together.

Using a continuous futures contract means that you will no longer have to roll or re-enter expired contracts. Additionally, it allows you to chart the future across multiple expiries, and apply moving averages and other technical studies that aren't relevant with the limited life of a single monthly or quarterly contract.

Find out about...

Adding a continuous futures contract

Generating normalized historical data series for Continuous Futures

To enter a continuous futures contract using Mosaic Watchlist

Click in an empty row and enter the underlying symbol.

Hit enter, and select the futures contract from the list.

From the selector, choose the contract with the infinity sign (∞)which denotes a continuous futures contract.

The market data line for the future will also show the infinity sign.

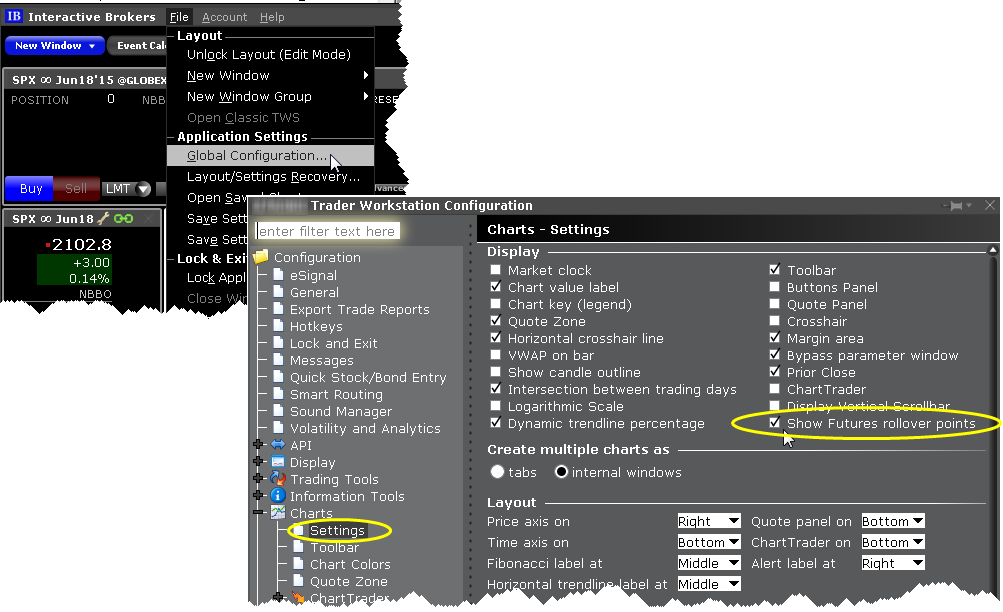

To see the Ratio Adjustment (RA) Points on a chart

- Open the Charts>Settings page in Global Configuration and enable Show futures rollover points.

Note that these continuous contracts are for market data only; orders on futures are not updated. If you select a non-continuous contract, the Automatic Futures Rollover feature (if enabled) will notify you that the contract is expiring.

To generate normalized historical data series for Continuous Futures

A "continuous futures" contract represents a sequence of successively expiring lead futures contracts along with an associated interval during which each future is the lead. This allows us to construct a normalized historical data series for the contract. For example, we can construct a continuous futures contract for CL@NYMEX using the following contracts:

CL MAY'15

CL APR'15 20150317

CL MAR'15 20150217

CL FEB'15 20150115

CL JAN'15 20141216

CL DEC'14 20141117

CL NOV'14 20141016

CL OCT'14 20140917

CL SEP'14 20140817

CL AUG'14 20140717

CL JUL'14 20140617

CL JUN'14 20140515

CL MAY'14 20140417

The above list of sequential contracts shows the lead end dates when the particular contract stops being the lead contract and the next one takes over.

To generate a normalized historical data series for the above sequence, call CL MAY'15 as Contract A and CL APR'15 as Contract B. Then follow the steps below:

Take the closing price of Contract B and Contract A on 20150317.

Calculate the ratio of closingPrice(Contract A)/closingPrice(Contract B).

Multiply all Contract B data for 20150317 and all prior dates by this ratio. This results in the adjusted time series of Contract B having the SAME closing price on 20150317 as Contract A.

Repeat for prior months.

© 2016 Interactive Brokers - TWS用户指南