Relative Momentum Index

The Relative Momentum Index (RMI) is a variation of the Relative Strength Index (RSI). While the RMI counts up and down days from today’s close relative to the close ”n-days” ago (n is not limited to 1), the RSI counts days up and down from close to close.

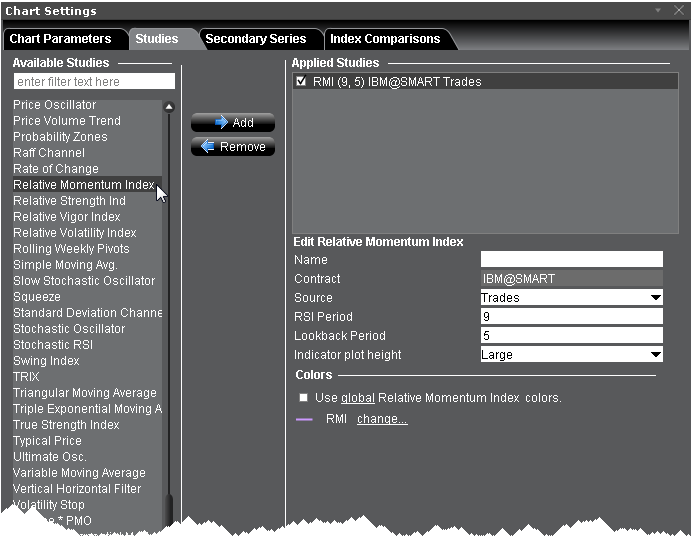

To apply a Typical Price Indicator

- From within a chart, from the Edit menu select Studies.

- Choose Relative Momentum Index and click Add to add the study to the Applied Studies group.

- Complete parameters as necessary.

Once the study is defined, you can elect to uncheck/check to remove and add the study to your chart.

© 2016 Interactive Brokers - TWS用户指南