Quick Links

Overview

Creating a Spread

Combination Selector

- Pair or Leg-by-Leg tab

- Multiple tab

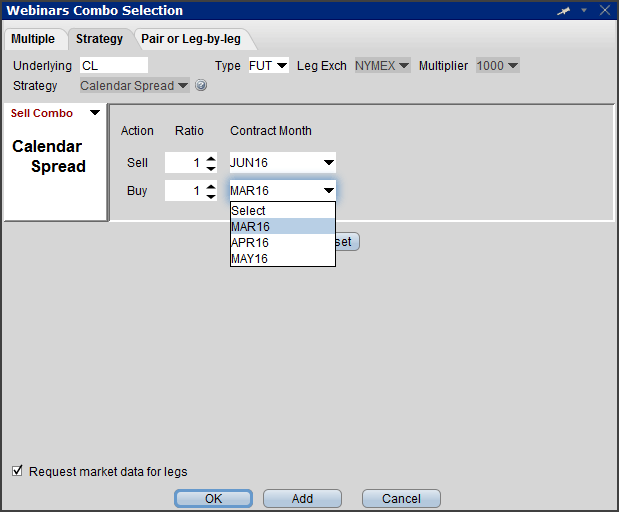

- Strategy tab

- Quick Entry for Futures Calendar Spreads

- Inter-Commodity Futures Spreads

- Virtual Securities

Strategy Builder for Options Spreads

- Mosaic

- TWS OptionTrader

- Spread Pricing

- Performance Profile for Complex Strategies

- Option Rollover and Write Options Tools

- Option Rollover

- Write Options Tool

Order Types

Overview

In TWS you can construct combination/spread orders for pairs trading of two correlated stocks or to roll forward future positions with a calendar spread. You can also create a stock with an option combination such as a covered call or any of multiple option spread strategies.

Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call."

On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position.

The Complex Positions setting can be enabled/disabled in the Display > Ticker Row page of Global Configuration. You may also want to activate in Display > Settings > Show Combo strategy title first.

Creating a Spread

There are two basic steps to create a Spread/Combination order:

Define the Combination – Identify the contracts to be used in creating the spread. Once the legs are defined, TWS calculates the price difference between the contracts and displays implied combination prices in the quote panel with a combination market data line – easily distinguishable with the magenta tick dot.

Create/Submit an Order – From this implied quote line of combination market data, the same quick-click order entry process you use throughout TWS applies. Click the bid or ask field to initiate an order line. Review, modify & transmit.

Build the Combination

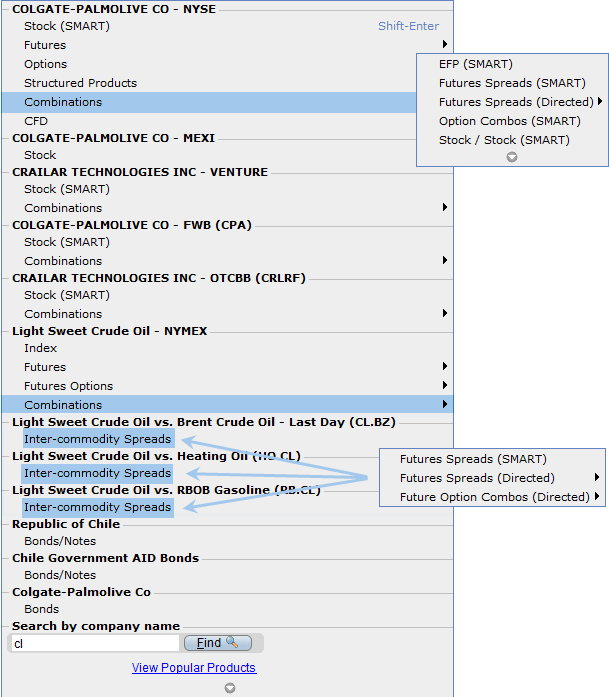

In the Contract field of your Watchlist (or Quote Monitor) enter a ticker symbol and select to create a Combination by instrument type. Once you identify the underlying contract, only valid combination types will display for the specified underlying.

Using the ticker CL as an example, when you choose Combinations for the underlying equity you can create an EFP (Exchange of Future for Physical) or SSF (Single Stock Future) spread, a stock/stock combo or an options spread.

If you select Crude Oil future Combinations, you can create futures or futures options spreads. Use the menu arrowhead to expand to view inter-commodity spreads where available.

Combination Selector

Easily create combination orders with the Combo Selection tool. Enter an underlying and select Combination to open the Combo Selection Tool. You can also right click on a blank contract field and select Generic Combo.

Pair or Leg-by-Leg tab

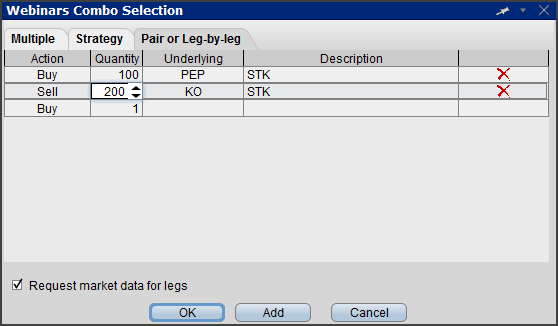

Create a generic Stock/Stock Pairs Trade spread by defining two individual legs:

- Enter a stock ticker and choose Combination > Stock/Stock.

- Pairs tab opens to enter the second stock.

- You can specify separate quantities for each leg. Then click OK.

- A description window opens to identify the combination.

- The combo implied bid/ask prices appear in your Watchlist/quote monitor windows, identified with a pink tick dot.

Multiple tab

Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Filtering choices on the left let you narrow the available selections. Use Ctrl+click to add multiple spread quotes to your monitor/watchlist.

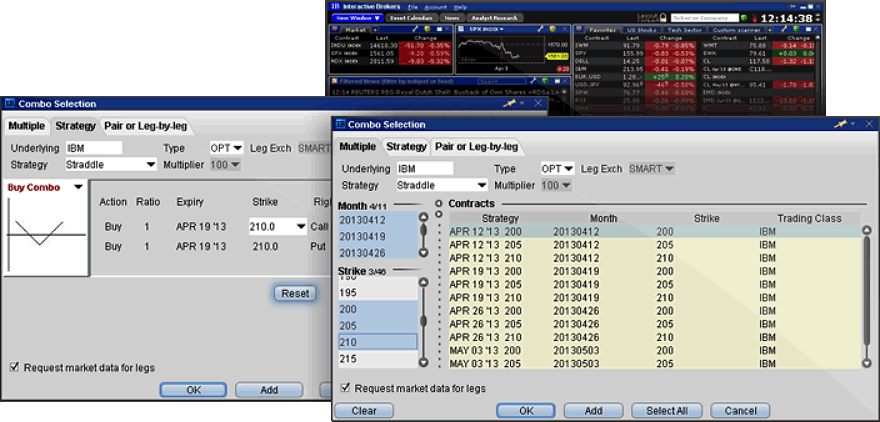

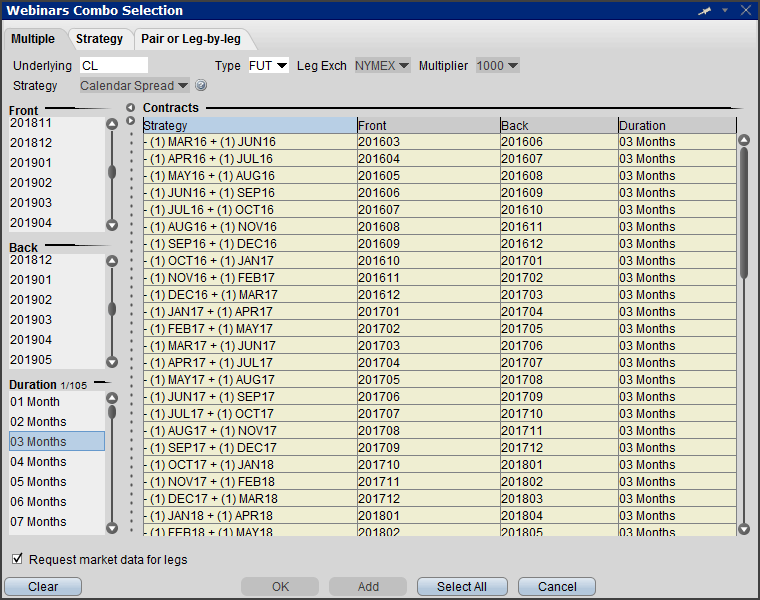

Strategy tab

Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract.

The Strategy tab contains a worksheet for Calendar Spreads. To roll forward an existing position – buy the further out contract and sell the held contract. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display.

To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Close out dates are listed in the Account Management Trade reference guide under: Delivery, Exercise and Corporate Actions

Quick Entry for Futures Calendar Spreads

You can also add futures calendar spreads by entering the two symbols separated by a dash (-).

For example, to enter a CL June 16/Sep 16 calendar spread, enter "CLM6-CLU6" or "CLM-U6"

| January | F | July | N |

| February | G | August | Q |

| March | H | Sept | U |

| April | J | October | V |

| May | K | November | X |

| June | M | December | Z |

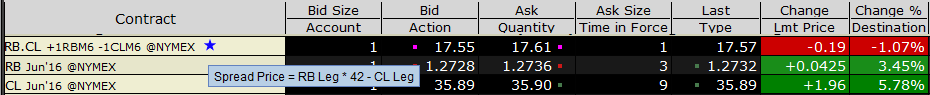

Inter-Commodity Futures Spreads

TWS supports direct-routed native inter-commodity futures spreads in TWS. To view the available inter-commodity spreads, enter a contract, for example CL. Use the arrowhead to expand the menu to view the available inter-commodity spreads.

- Hold your mouse over the spread to see the combo description.

- Hold your mouse over the blue star to see the price calculation.

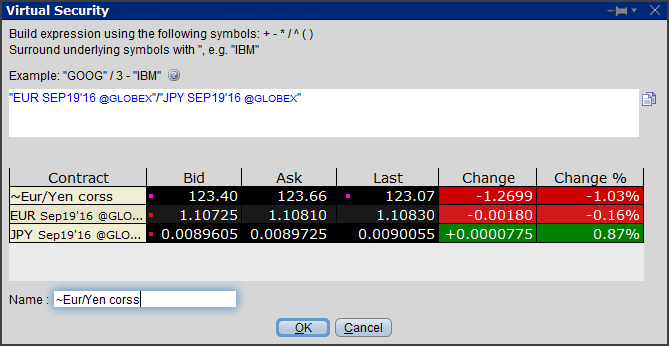

Virtual Securities

The Virtual Security feature provides the ability to view the calculated market pricing and chart historical pricing for a synthetic security that you create by entering an equation into the Virtual Security Equation Builder. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools.

To create a virtual security:

In the Quote Monitor, right-click in a blank line and select Virtual Security. Using the equation builder, define the custom security. Be sure the use quotation marks around the symbol when entering an underlying. Enter a "~" name for the virtual security and click OK. The security is listed as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices.

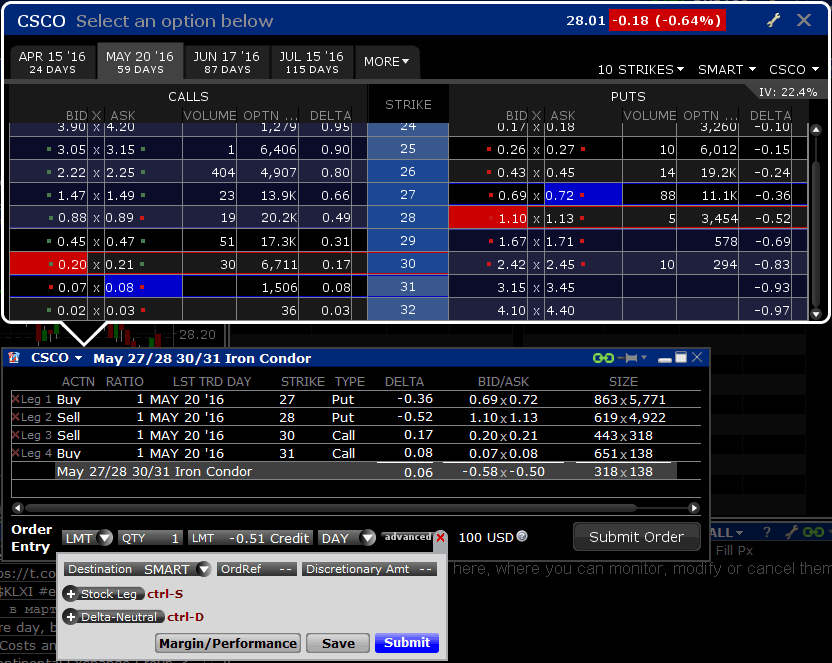

Strategy Builder for Options Spreads

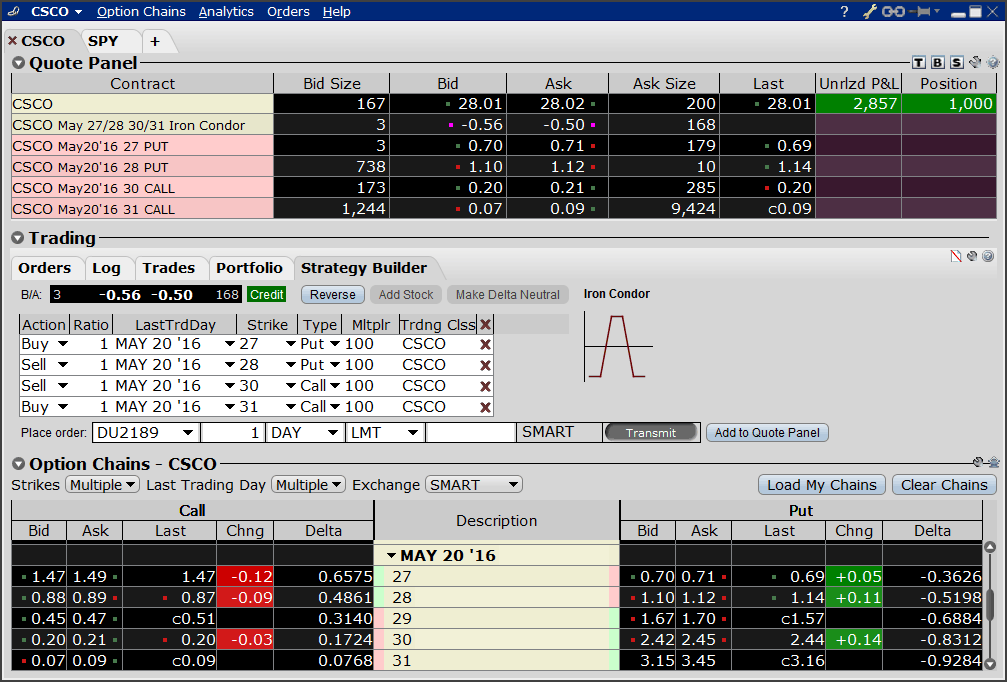

The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread.

Open the Strategy Builder from the Mosaic Option Chains window or from the Classic TWS OptionTrader Order Management panel.

To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell (write) that contract. TWS builds the spread as you select each leg. Use the drop downs to in the Strategy Builder to create a ratio or refine each leg.

Mosaic:

Always check your order before submitting. In the Mosaic order window use the advanced+ button and select Save which puts the un-transmitted trade in the Activity Monitor where you can see verify each leg of the spread.

TWS OptionTrader

Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. The implied spread price is displayed with a pink tick dot.

Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Click the bid/ask price from the implied quote line to create the spread. Credit or Debit spreads are color coded in the Bid/Ask row as well as left of the Transmit button. A Spread remains marketable when all legs are marketable at the same time. A missing bid /ask price in the implied price indicates one or more of the legs have become unmarketable.

To add a Stock component to your Combinations

In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write (Covered Call) or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. Use the system calculated delta or enter your own.

You can find these same functions in the Mosaic Order Entry window, by expanding the advanced+ button.

Spread Pricing

Remember that because you can build the same combo with positive or negative bid/ask prices that:

- Buying a positive price and selling a negative price pays a debit

- Buying a negative price and selling a positive price collects a credit

You MUST be vigilant about the price entered because once transmitted you are responsible for the trade. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell".

Check the User Guide for Notes on Combination Orders

TIP: To edit the price – click in the price field and use the same positive or negative price that was populated (it's the positive or negative price that determines a debit or credit spread.)

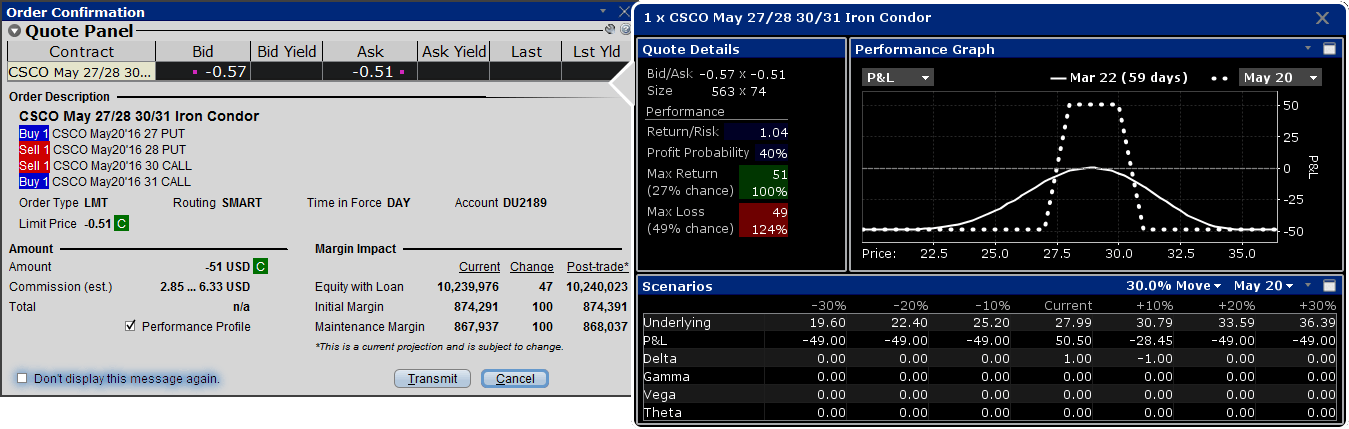

Performance Profile for Complex Strategies

A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. This feature includes:

- an enhanced Quote Details window that shows the Return/Risk Profit Probability and potential Max Return & Max Loss;

- Performance Graph shows the P&L (or any of the Greeks) as a function of the underlying price. Change the performance graph to display any of the Greeks with the pull down menu.

- Scenarios window that displays the effects of a change in underlying price on the P&L, the Greeks, and the volatility of a positions. Select % price move and expiration date for scenarios.

Option Rollover and Write Options Tools

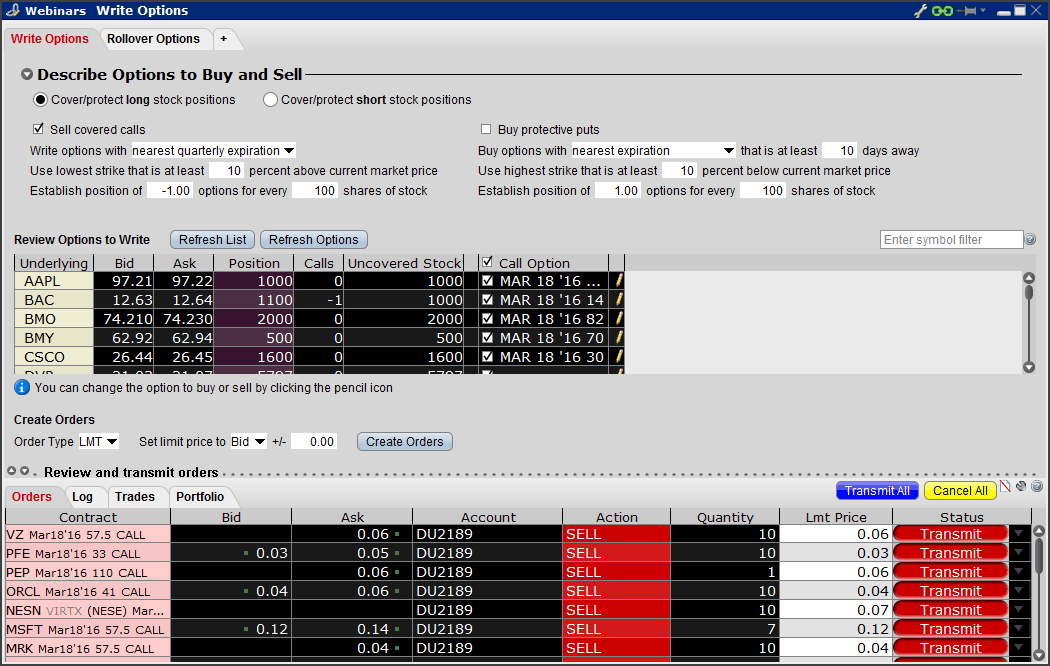

Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool.

On each tab, you specify the selection criteria, then choose Refresh/Load button to list the contracts based on your portfolio. Pencil icon allows you to edit the automatically selected contracts.

Option Rollover

To avoid deliveries in expiring option and future option contracts, you must roll forward or close out positions prior to the close of the last trading day.

Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date.

- Describe section has drop downs to specify the roll-to criteria.

- Click Refresh to view the roll-to contracts based on your inputs.

- The pencil icon next to the Roll-To field for each contract will allow you to modify selected contract.

- Select order type and any price offsets, then click Create Orders button.

- Calendar spreads are created in the Order management panel.

- Review. You can Transmit orders individually or use the Transmit All Button.

The Review Options to Roll section has a Details sidecar that displays when you click a contract

Write Options Tool

Sell calls against your long stock positions, write puts on short positions, or create collars with the Write Options tool, which displays all long/short underlying positions in your portfolio.

Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Simply check both Sell Calls and Buy Puts in the Describe section. Additional columns populate based on your inputs.

- Describe section has drop downs to quickly specify selection criteria.

- Click Refresh to view selected contracts based on your inputs.

- TWS calculates how many contracts to write based on your long/short stock positions, and how to split the desired number of contracts between multiple Advisor accounts.

- Create Orders. Orders will display in the Orders panel.

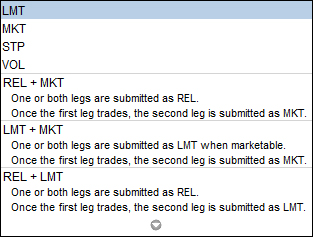

Order Types

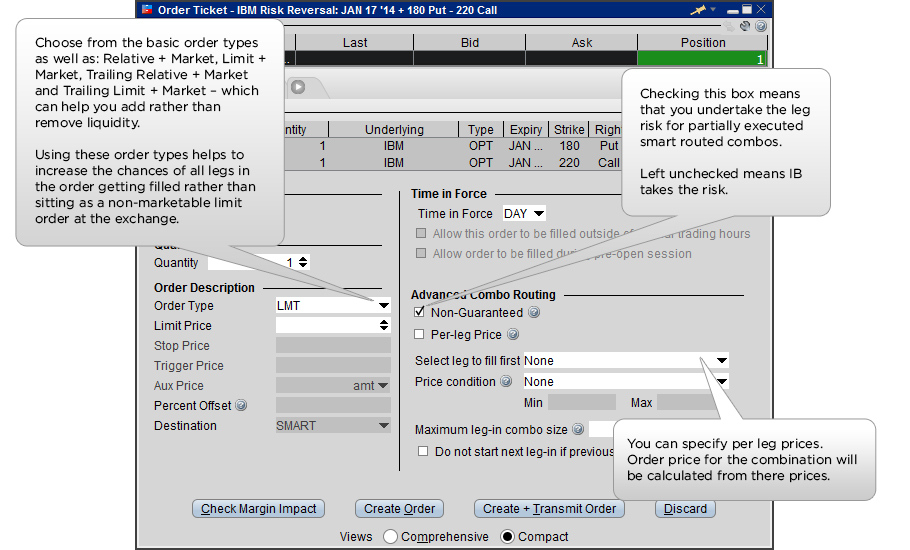

Choose from the basic order types as well as: Relative + Market, Limit + Market, Trailing Relative + Market and Trailing Limit + Market. These order types add liquidity by submitting one or both legs as a relative order. Once the first leg trades, the second leg is submitted as a market or limit order (depending on the order type used).

The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Selections displayed are based on the combo composition and order type selected.

Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders.

Guaranteed and Non-Guaranteed Multi-Leg Orders

- A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and proportionately to the leg ratio. Available only for Smart-Routed U.S. option spreads and stock /option combination orders. Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by IB.

- Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled.

- multi-leg orders are not guaranteed to be executed proportionately to the leg ratio although every effort is made to execute the order that way.

- for a more aggressively routed order, check the Non-Guaranteed checkbox at order entry to take on the leg risk inherent for partially-filled combo orders yourself.

Non-US Products Smart-routed Combos – Please note that non-US combos are always non-guaranteed, which means that a single leg may fill without the entire combination being filled. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. Non-guaranteed Combination Orders.

SmartRouting

For options traded at multiple exchanges, IB recommends our intelligent best execution system – SmartRoutingSM which displays the NBBO from all available routing venues.

- Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market(s) for the fastest fill at the most favorable price.

- Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. Smart routing is available on stocks and options in the US and Europe.

Advanced Order Routing

Advanced Combo Routing is used to control routing for large-volume, Smart-routed spreads. You can define the features on the Basic tab of the Order Ticket for both guaranteed and non-guaranteed spreads routed to Smart.

Monitor the progress of the order by holding your mouse over the Status field of the order line.

These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. You should be aware that your losses may exceed the value of your original investment.