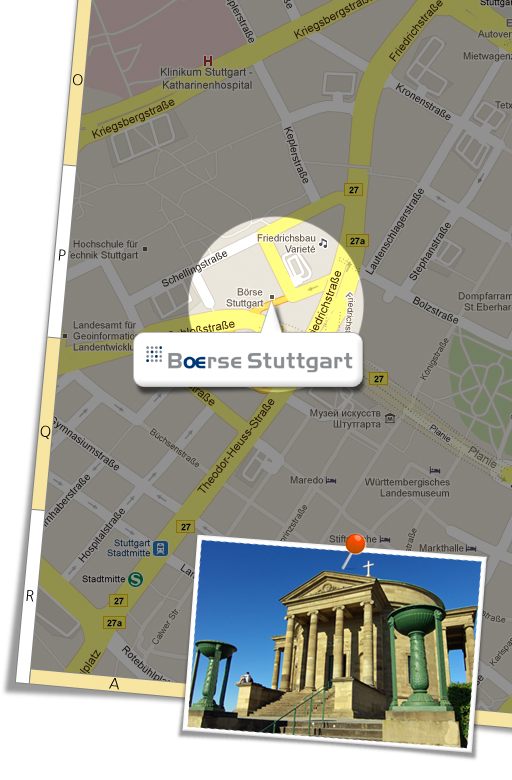

Stuttgart Stock Exchange

Stuttgart Stock Exchange (Boerse Stuttgart, SWB) was founded in 1860 and is Germany's second-largest stock exchange. The exchange offers trading in leverage and investment products, equities, exchange-traded products (ETPs), bonds, investment fund units and participation certificates.

The Stuttgart market model has one Quality Liquidity Provider (QLP) for each trading segment that provides liquidity and checks all quotes and entries. The presence of the QLP is beneficial for market participants, particularly for trades in securities with low trading volume. Further, intervention by the QLP seeks to avoid partial execution of orders and guarantees orders are executed at the Stuttgart stock exchange according to the best price principle.

Among the trading segments of Boerse Stuttgart are Euwax, for the trading of securitized derivatives, 4x, for the trading of international securities, bondx, a special quality segment for trading bonds and other products, ifx, for investment fund trading, and ETF Bestx, for regulated trading with index funds.

Euwax, or the European Warrant Exchange, the trading segment of Boerse Stuttgart for securitized derivatives, facilitates electronic trading of derivative leverage products, including warrants, knock-out products, exotic products and investment products, and derivative investment products, including reverse convertibles.

Liquidity in Euwax products is supported by market makers who provide continuous quotes for a set minimum volume, and by the Quality Liquidity Provider (QLP). Orders are executed according to the best price principle; an investor’s order is executed by the system at a price at least as good as, if not better than, market maker quotes.