The Close Price algo is designed to minimize slippage with respect to the closing price by slicing orders into smaller quantities and executing them in the continuous market just before the close. It considers the user-assigned level of market risk, the user-defined target percentage of volume, and the volatility of the stock in determining how long before the close it should start executing the trade, and the pace at which the trade should be executed.

This strategy is especially useful when the volume to be executed is large relative to the average close auction volume and submitting the entire order into the close auction via an MOC or LOC order would adversely impact the closing price.

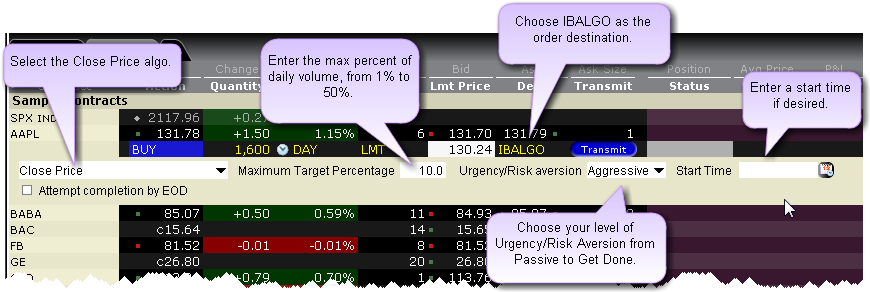

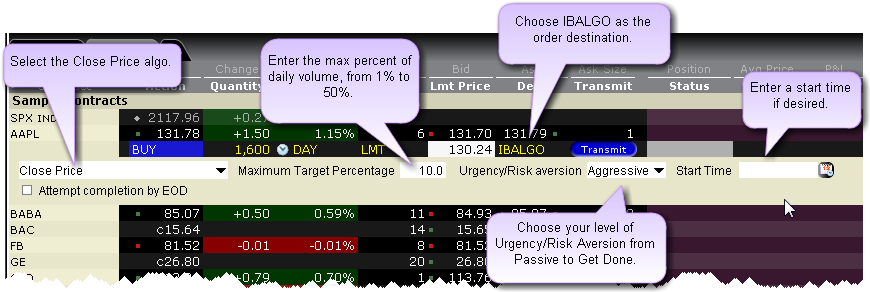

To submit the Close Price IBALGO Order

1. Create an order in Classic TWS. Click the Ask price for a buy order. Click the Bid price for a sell order.

2. From the Destination field, select IBALGO (near the bottom of the list).

3. Select Close Price as the algo.

4. Set the Maximum Target Percentage of the average daily volume from 1% to 50%.

5. Set the Urgency/Risk Aversion. Select from the most aggressive Get Done to the least aggressive Passive. This value helps to determines the pace at which the order will be executed. High urgency may result in greater market impact.

6. Specify the start time if desired.

7. Attempt completion by EOD - If checked your order will be executed by the end of day if possible. Please note that a portion of your order may be left unfilled if the risk of the price changing overnight is less than the extra cost of executing the whole order today regardless of whether the EOD box is checked.

8. Transmit the order.