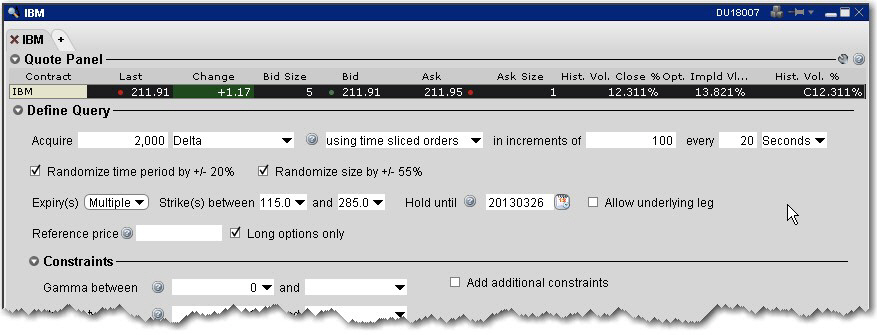

Define the query by entering the quantity of the risk dimension you wish to acquire, and setting optional specifications such as time slicing and randomization, last trading day and strike range, and an underlying reference price range and Hold until date. You can also elect to create a Reference Portfolio and have the Option Portfolio query an optional portfolio with the same or better P&L.

To define a query

The position quantity is equal to:

greek value x position x multiplier

For example, 20 long call options with a delta of .4989 would show a position Delta of approximately 1000. The position Delta calculation is:

.4989 x 20 x 100 = 997.8

Parameter | Description |

Time-sliced orders | Select this option to acquire the total objective in smaller increments, with orders being submitted at user-defined time intervals of seconds, hours or minutes.

|

Randomize time period by +/- 20% | When you check the Randomize time checkbox, the Option Portfolio randomly changes the user-defined time interval by any value up to as much as 20% in either direction. For example, an order with a time interval of 30 seconds might randomly be submitted at varying intervals of 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34 35, 36 seconds.

|

Randomize size by +/- 55% | When you check the Randomize size checkbox, the Option Portfolio randomly changes the user-defined size increment by any value up to as much as 55% in either direction. For example, an order using increments of 500 might randomly return orders with an objective anywhere from 275 up to 775.

|

Range of Last Trading Days | Select the last trading day(s) you are willing to trade.

|

Strike Range | Select the range of strikes you are willing to trade.

|

Reference Price |

By default, the midpoint of the bid/ask of the underlying price is used to calculate the objective. Enter a reference price if you prefer to use a value other than the midpoint of the underlying price. Note that an alternate reference price cannot be used if the Price between constraint is used. |

Hold until | Enter a date if you want to hold the solution in the Query Results list until a specific date.

|

Long/Short options only | Checked by default. Constrains the solution to only include long or short option trades, as appropriate. For example, when buying or selling Delta, long options would be more appropriate to avoid the risk of being short options. The text will change based on the objective and signed quantity. When requesting short gamma, short vega or long theta, the text will read “short options only.” |

Allow underlying leg | Check to allow a stock leg in the proposed solution list. |

Add other constraints if needed (see Constrain the Query Results).

Submit the query by clicking the Submit Query button.