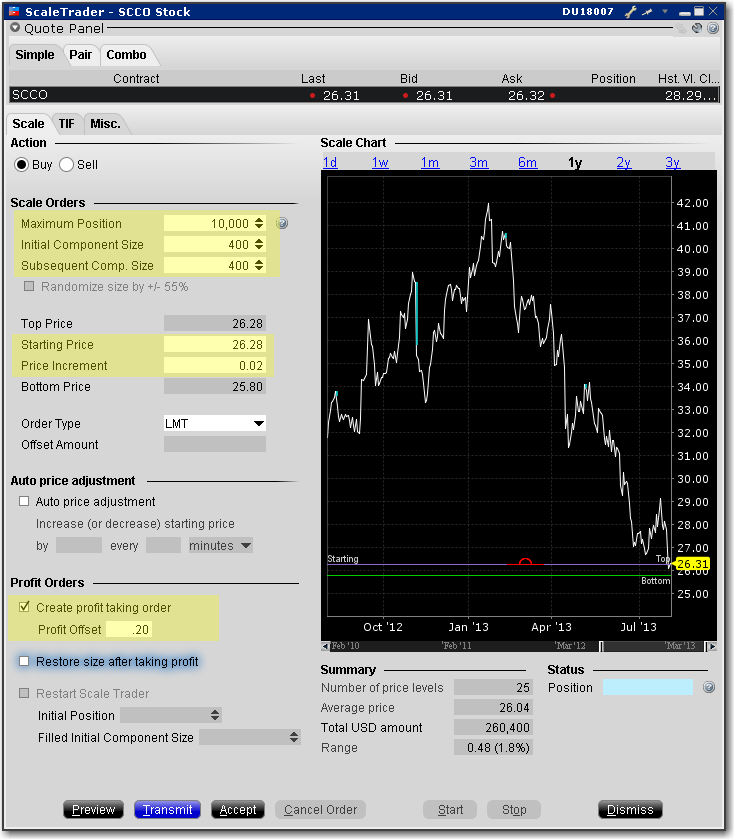

Data Assumptions:

|

Label |

Value |

|

$26.31 - $26.32 |

|

|

Action |

Buy |

|

10,000 |

|

|

400 |

|

|

$26.28 |

|

|

.02 |

|

|

Order Type |

Limit |

| Create profit taking order | Check to enable |

| Profit Offset | 0.20 |

Like example 1, this is an order to buy 10000 shares scaled into 25 components of 400 shares each. In addition, we have instructed

The first 400 share component is submitted as a buy limit order at the Starting Price of $26.28. When the component order fills two things happen. The next component of 400 shares is submitted at $26.26 (component price - price increment), and a sell order is submitted for 400 shares at $26.48 (component price + profit offset).

When the $26.26 price level fills, a sell order for 400 shares at $26.46 (component price + profit offset) is submitted. This pattern continues until all components have filled, or you cancel the order.

Note: The order will be held if any parent component becomes unmarketable, but the profit orders can continue to work without holding up the order.