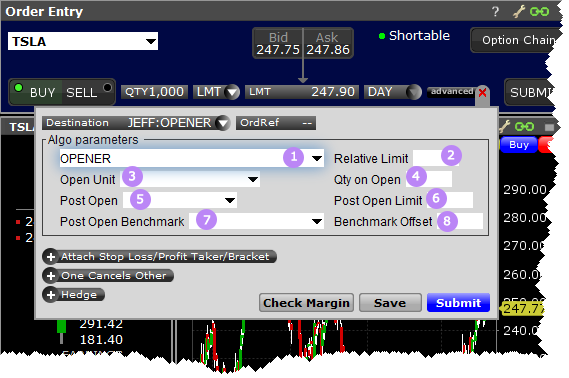

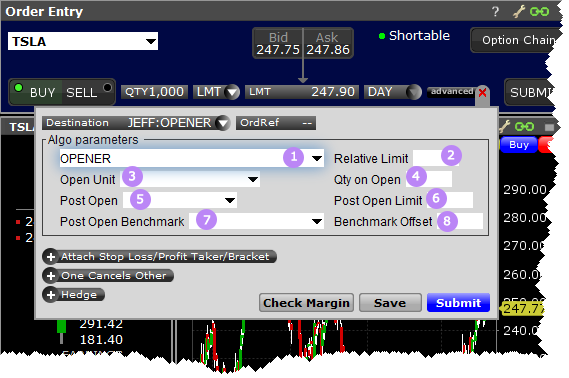

Benchmark algo that lets you trade into the open.

| Number | Description |

|---|---|

| 1 |

Choose algo |

| 2 |

Relative Limit - (optional) Positive and Negative values are allowed. Creates a "soft" limit on the order as a price move from arrival price by the specified number of basis points. The strategy will use the Arrival Price after Market Open, the day’s Opening price if the order is received before Market Open. |

| 3 |

Open Unit (optional) - Used to determine type of Open Quantity value.

|

| 4 | Qty on Open - (optional) - Used in conjunction with the Open Unit field to specify the quantity that will be placed into the opening auction. Positive numbers only. If Open Unit is Shares, the Open Qty must be equal to or greater than 1 round lot. For any % option, the value must be less than or equal to 100. |

| 5 |

Post Open (optional) - Select the strategy to use for the opening auction:

|

| 6 | Post Open Limit - (optional) - Absolute limit price for the post-open strategy. This limit will be ignored if it exceeds the overall limit or relative limit price. |

| 7 |

Post Open Benchmark - (optional) –

|

| 8 | Benchmark Offset - (optional) – Positive or Negative value in basis points set as the Relative Limit from the Post Open benchmark. These fields work together to set the Relative Limit for the Post Open strategy. If the Post Open Limit is specified then the order will use the value that is more passive. |

To use Jefferies algos, select JEFFALGO as the routing destination.