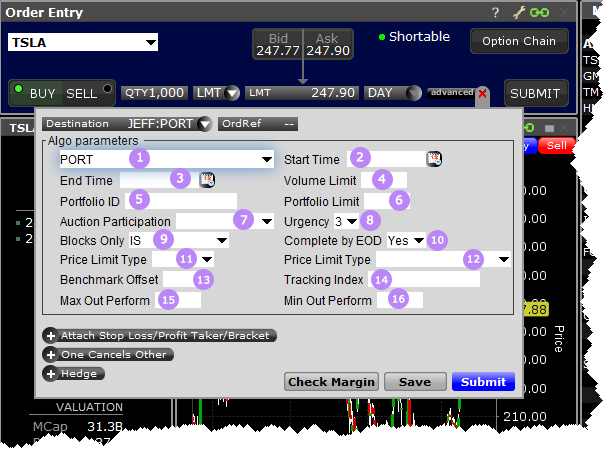

Execute a group of stock orders according to user-defined input plus trading style.

| Number | Description |

|---|---|

| 1 |

Choose the algo. |

| 2 |

(optional) Set a start time. |

| 3 |

(optional) Set an end time. |

| 4 |

Volume Limit - (optional) Max rate of volume. |

| 5 | Portfolio ID (optional) - Set a user ID. |

| 6 | Portfolio Limit (optional) – Positive or negative value indicating the number of basis points from the arrival price. Values from -10,000 to 10,000. |

| 7 | Auction Participation - (optional)

|

| 8 | Urgency (optional) Passive, Active or Aggressive. |

| 9 |

Blocks Only (optional) –

|

| 10 | Complete by EOD (optional) – Define urgency to complete by the end of the trading day. |

| 11 | Price Limit Type (optional) – Fixed or Floating |

| 12 |

Benchmark - (optional)

|

| 13 | Benchmark Offset(optional) – Positive or negative value in basis points. |

| 14 | Tracking Index (optional) – User-specified text |

| 15 | Max Outperform (optional) - Positive or negative value in basis points. |

| 16 | Min Outperform (optional) - Positive or negative value in basis points. |

To use Jefferies algos, select JEFFALGO as the routing destination.