This algo allows you to participate via volume at a user-defined rate that varies over time based on the price of the security. It lets you buy more aggressively when the price is low and less aggressively as the price increases, and just the opposite for sell orders.

To recalculate the percent of volume applied with each price change:

Target Percentage - 100 x Order Side x Target Percentage Change Rate x Percent change in price

where Order Side = 1 for buy, -1 for sell.

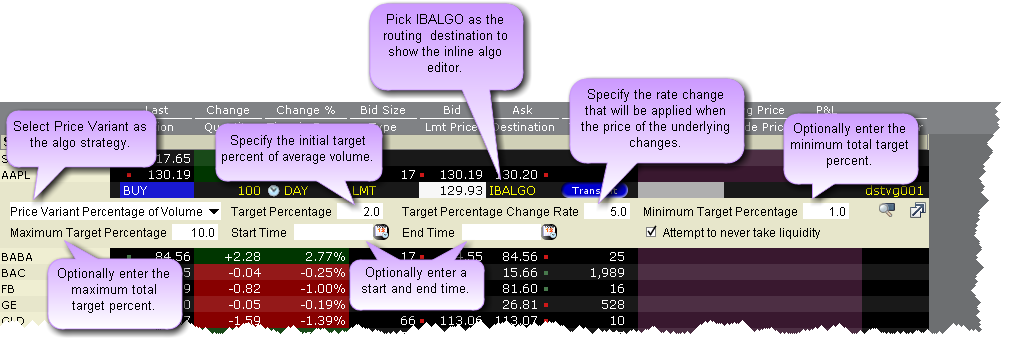

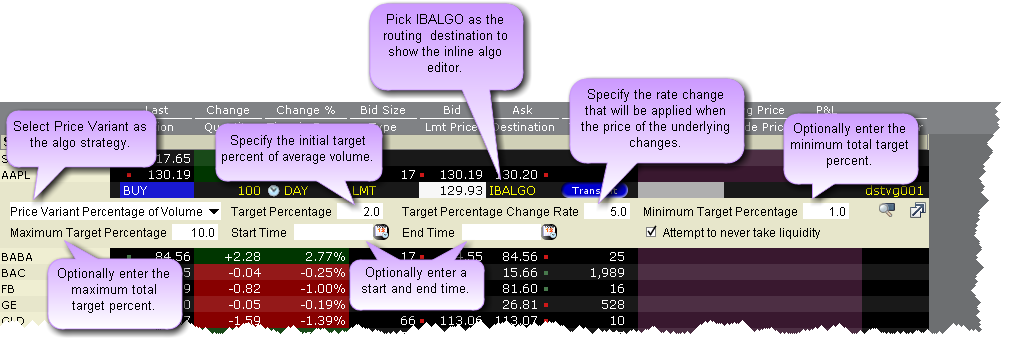

To submit the Price Variant IBALGO Order

1. Create an order in Classic TWS. Click the Ask price for a buy order. Click the Bid price for a sell order.

2. From the Destination field, select IBALGO (near the bottom of the list).

3. Select Price Variant Percentage of Volume as the algo.

4. Set the Initial Target Percentage of the average volume to start off the order. Enter "1" for 1% etc.

5. Set the Target Percentage Change Rate which will control how the target percent of volume will be adjusted with price changes to the underlying.

Note: Each price change triggers a new calculation for the current percent of volume.

6. Specify a minimum and maximum target percentage if needed.

7. Specify the start time and end time if needed. Otherwise the algo will start when you transmit the order and end at the market's close.

8. Attempt to never take liquidity - If checked the order is guaranteed not to hit the opposite side, and it will trade at a price better than or equal to the limit price.

9. Transmit the order.