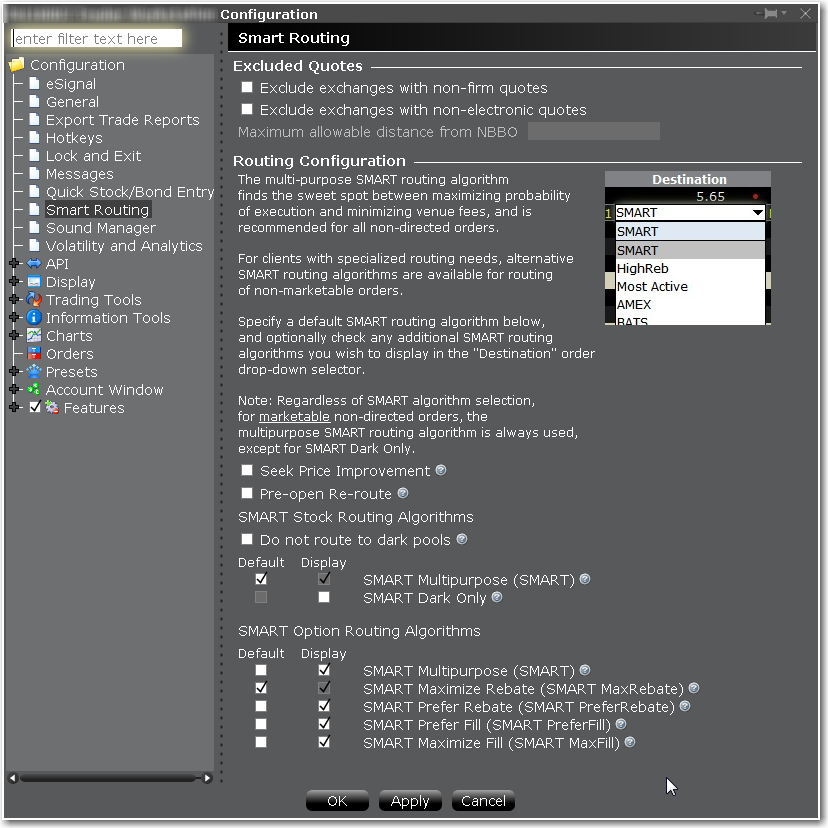

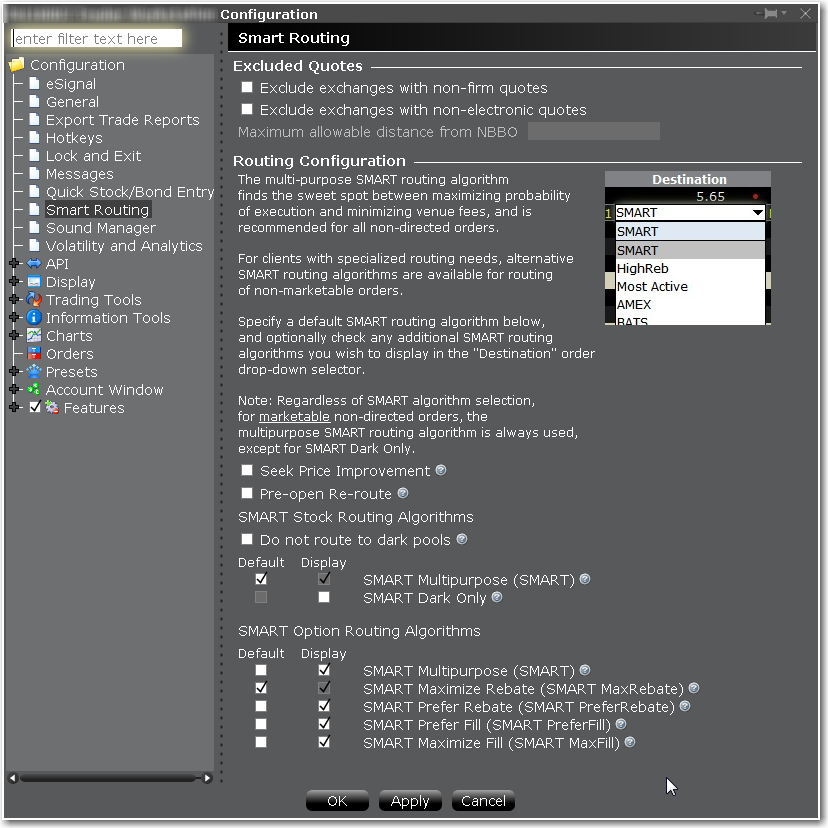

You can define event-specific directives for contracts routed through

To modify SmartRouting functionality

IMPORTANT If you choose to: a) exclude quotes from certain exchanges; b) exclude non-firm quotes; or c) exclude non-electronic quotes, your order may not be executed at the best posted price nationally (the “NBBO”). This is because one of the exchanges that you chose to exclude might have the best posted price but that exchange will be bypassed by the

In addition, if you exclude certain exchanges from the eligible SmartRouting destinations and your order is routed to another exchange with an inferior posted price, your order may not be executed by the exchange to which it is sent because that destination may not be willing to execute at an inferior price, or your order may not be marketable at that exchange. You should carefully evaluate all of these factors before deciding whether to exclude certain exchanges from the eligible IB SmartRouting destinations.

If checked, Smart routing will sweep certain exchanges for hidden liquidity at more favorable prices. This may result in slower executions.

This allows you to route orders to major exchanges three minutes before the open. For orders submitted before the open, checking this box ensures your orders are routed prior to the open. This directive only applies to stocks listed on a major exchange, and cannot be used if the Ignore Opening Auction order attribute is set.

Do not route to dark pools - For stock and warrant orders only. When checked, all dark pool destinations will be bypassed by the IB Smartrouter.

Customers who have the unbundled "Cost Plus" commission structure for stocks have the ability to choose from a list of Smart routing strategies for non-marketable stock orders to complement their trading strategy.

Use the checklist to select a single "Default" strategy which will automatically be applied to any non-marketable, Smart routed stock order, and any number of "Display" strategies, each of which will be available from the Destination field as a per-order selection.

Available strategies include:

Highest volume exchange with rebate (SMART VRebate) - Routes your non-marketable order to the exchange with the most volume that also offers the highest rebate for added liquidity.

Note: On a best efforts basis, the IB SmartRouting system will attempt to capture a rebate on your order. However, not all trades will receive a rebate, as best execution at the best possible price remains the top priority.

To change your pricing structure from bundled to unbundled and take advantage of this feature, log in to Account Management, and select Account Administration and then Pricing Structure from the left contents pane.

Choose how to route a smart-routed, non-marketable options order.

Smart-routing will attempt to post your order to an exchange where it will be at the top of the book. Enabling this feature does not guarantee that the order will be at the top of the book, and may reduce the likelihood of getting a fill on the order.