You can use an Account Group to automatically calculate ratios and allocate shares to a pre-defined group of accounts based on a selected allocation method. When you create an order and choose a group, the order uses the default method to allocate shares among the accounts in the group.

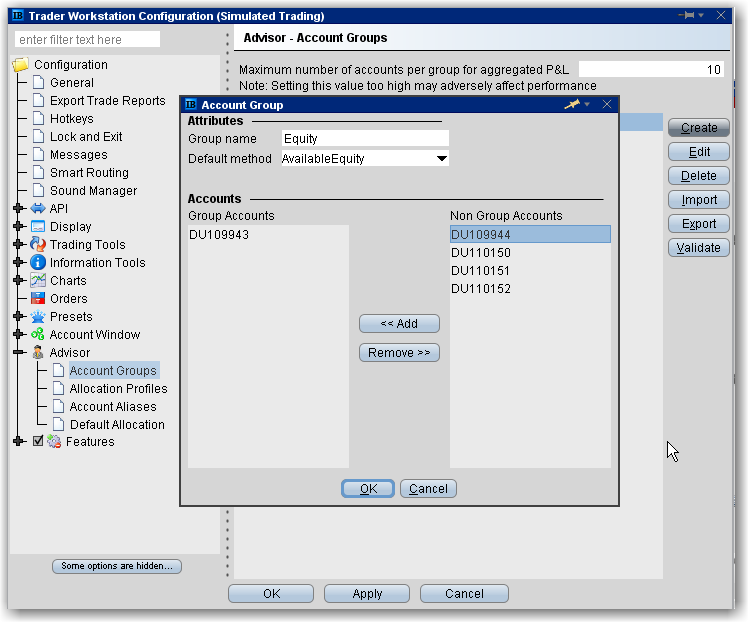

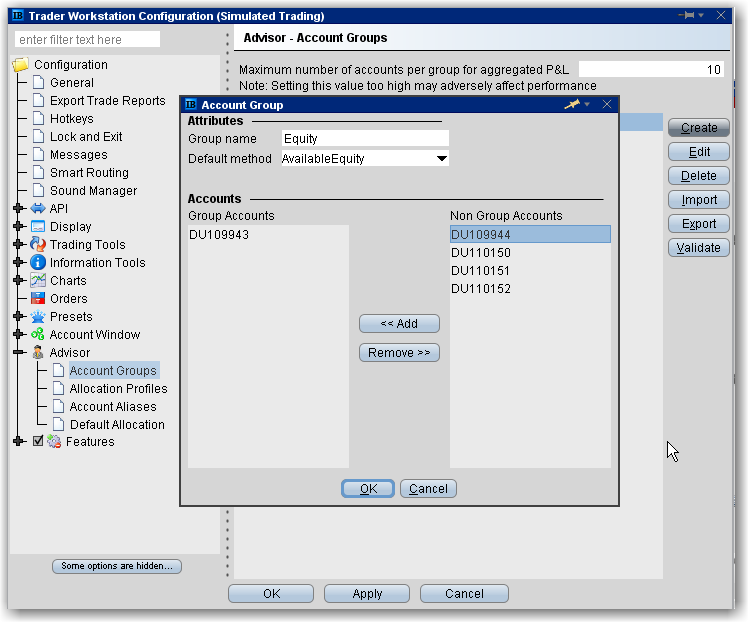

To create an Account Group

When you create an order, the choices displayed in the Allocation list are grouped first by Account Group, then Allocation Profile, and then individual accounts. However, they are not identified in any other way. When you create an account group, you may want to include a prefix such as "AG" in the name to identify the choice as an Account Group.

Example: You transmit an order for 400 shares of stock ABC. If your Account Group includes four accounts, each account receives 100 shares. If your Account Group includes six accounts, each account receives 66 shares, and then 1 share is allocated to each account until all are distributed.

Example: You transmit an order for 700 shares of stock XYZ. The account group includes three accounts, A, B and C with Net Liquidation values of $25,000, $50,000 and $100,000 respectively. The system calculates a ratio of 1:2:4 and allocates 100 shares to Client A, 200 shares to Client B, and 400 shares to Client C.

Example: You transmit an order for 700 shares of stock XYZ. The account group includes three accounts, A, B and C with available equity in the amounts of $25,000, $50,000 and $100,000 respectively. The system calculates a ratio of 1:2:4 and allocates 100 shares to Client A, 200 shares to Client B, and 400 shares to Client C.

BUY ORDER | Positive Percent | Negative Percent |

Increases position | No effect | |

No effect | Decreases position | |

SELL ORDER | Positive Percent | Negative Percent |

Long Position | No effect | Decreases position |

Short Position | Increases position | No effect |

Example 1: Assume that three of the six accounts in this group hold long positions in stock XYZ. Client A has 100 shares, Client B has 400 shares, and Client C has 200 shares. You want to increase their holdings by 50%, so you enter "50" in the percentage field. The system calculates that your order size needs to be equal to 350 shares. It then allocates 50 shares to Client A, 200 shares to Client B, and 100 shares to Client C.

Example 2: You want to close out all long positions for three of the five accounts in a group. You create a sell order and enter "-100" in the Percentage field. The system calculates 100% of each position for every account in the group that holds a position, and sells all shares to close the positions.