The Pegged to Surface volatility order for options pegs the starting price of the order to the implied volatility calculated by the Model Navigator, shown in the Model field below. For calls, buy orders will peg to the volatility bid and sell orders to the volatility ask. For puts, a bur order will peg to the volatility bid and a sell to the volatility ask. This order allows a positive, negative or no offset to the volatility.

Note: To see bid/ask volatility instead of prices, open the VolatilityTrader from the Trading Tools menu.

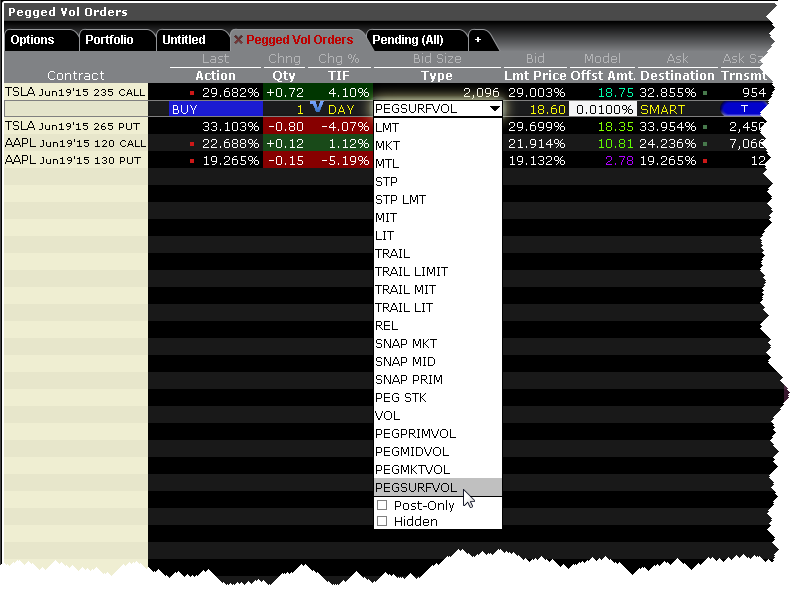

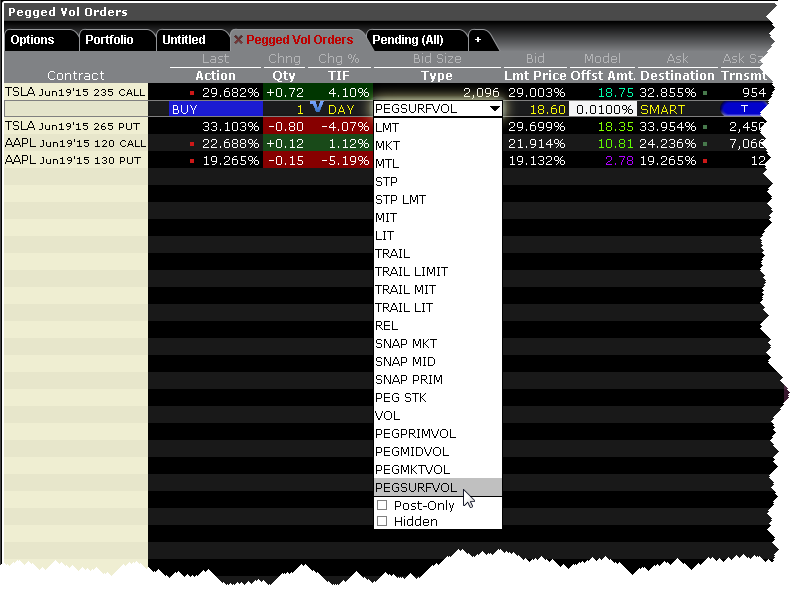

To create a Pegged to Surface Volatility Order

1. From the ticker line for an option, click the bid volatility to create a sell order, or the ask volatility for a buy order.

2. From the Type field select PEGSURFVOL.

3. Define the positive or negative offset amount if desired. A positive offset makes the order less aggressive. For a buy order a positive offset is subtracted from the bid, and for a sell a positive offset is added to the ask. A negative offset makes the order more aggressive. For a buy order the negative offset is added to the bid and for a sell the negative offset is subtracted from the ask.

4. Specify other order parameters as needed, including Continuous Update, Reference Price etc.

5. Click Transmit to submit the order.