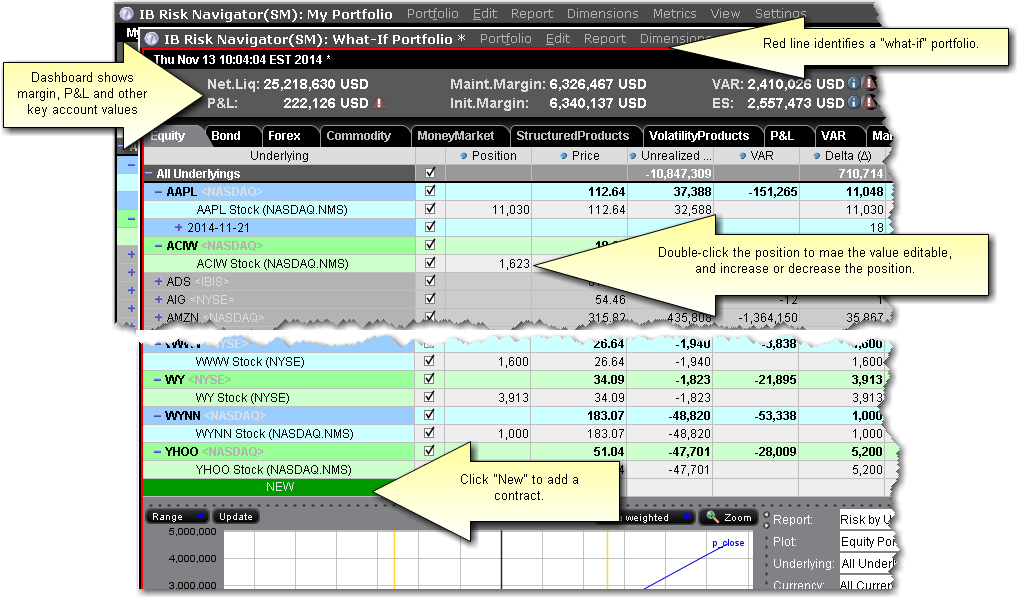

The What-if portfolio feature lets you create an editable, hypothetical portfolio based on your actual portfolio. This allows you to "make changes" to your portfolio, including adding, closing, reducing or increasing positions, to see how your risk profile would change. Additionally, you can check your margin requirements on the portfolio.

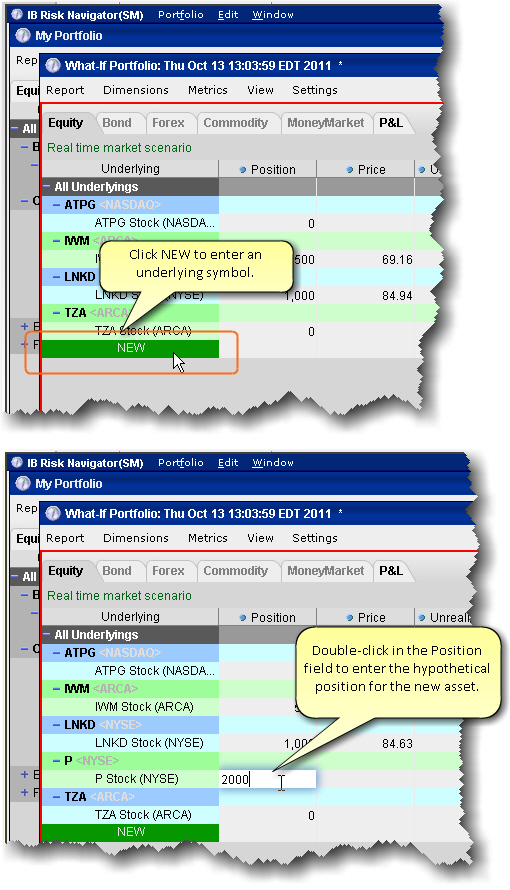

You can also build a new hypothetical portfolio, position-by-position, to see how the risk profile changes as positions are added and modified.

You can also create an order from within a What-if portfolio that will fill on an exchange. For details, See Create Orders from a What If Portfolio for more information.

What-if portfolios are outlined in red for easy identification, and display the What-if title at the top of the window.

To create a "what-if" scenario based on your current portfolio

To reload the last saved version

Use this command to reset all values in the active portfolio to the last saved version. This command only works on an unsaved file. An unsaved portfolio will display an asterisk "*" at the end of the title.

To add/subtract positions from other portfolio files

- The add/subtract feature nets out positions common to both portfolios, and creates a contract line for each new contract (even if the position is "0").

- You can add/subtract the same portfolio multiple times. Current positions are netted out each time.