You can create complex custom scenarios by editing the price, date and volatility variables. The examples below are only a few of the possible custom views available, and are meant to help you become familiar with the tool.

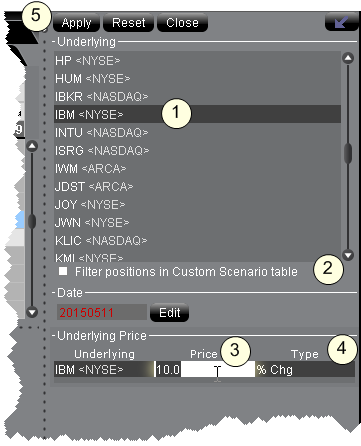

Custom Scenario Example 1: You want to view the impact on your portfolio of a 10% change in the underlying price of IBM.

Click Apply to see your changes reflected in the Custom Scenario table.

Modified data in the editor appears in red, indicating that you have not yet applied the changes. When you click Apply, the red color is removed.

To remove data changes, click the Reset button at the top of the editor.

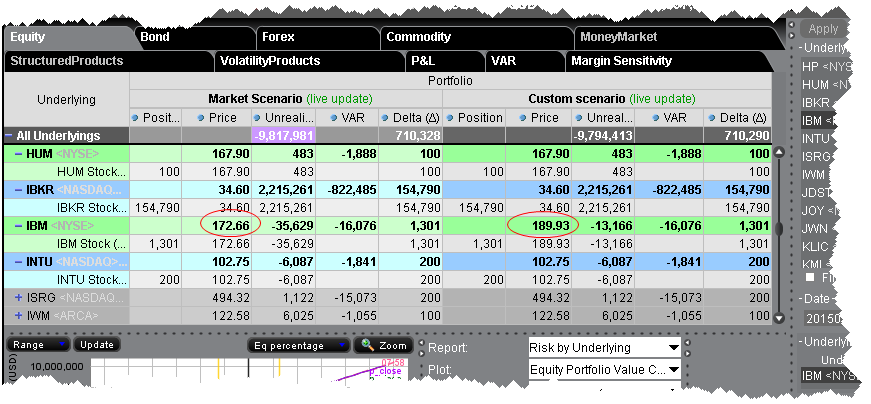

The effects of this change can be seen in the Custom Scenario, and can be compared with the realtime market data that appears in the adjoining Market Scenario. The underlying price change shows in the underlying stock line, and the trickle-down affect of this change can be seen in the Price, Value, Delta and Theta fields.