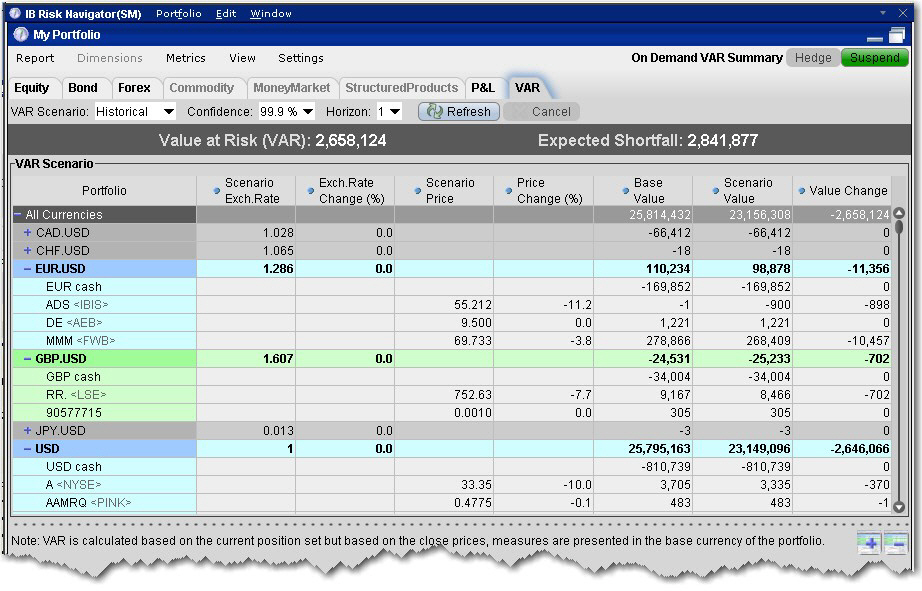

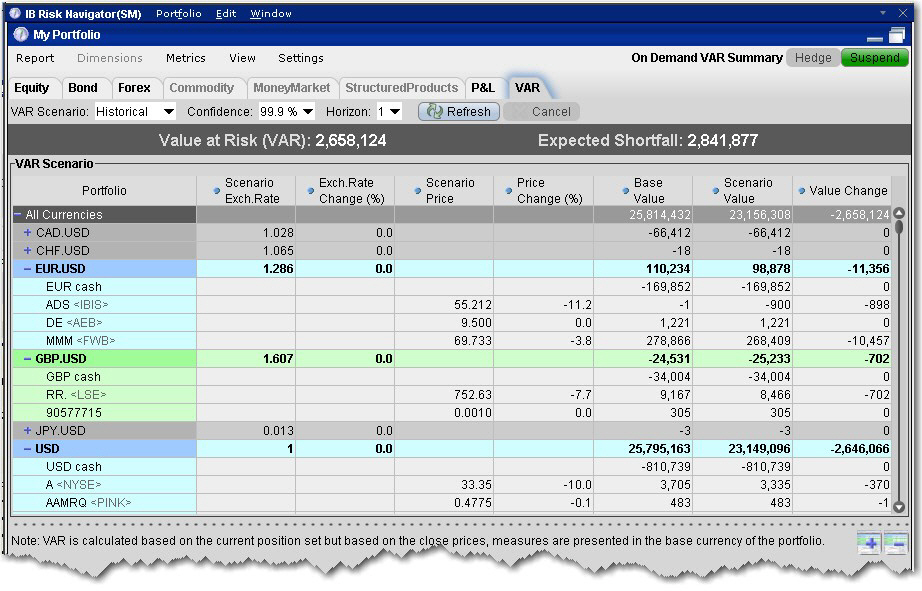

The Value at Risk represents the expected loss under normal market conditions, over a specific time horizon and based on the percent probability as defined by the confidence level. This is a theoretical value and does not represent the potential worst-case loss scenario.The On Demand VaR report calculates VaR for the entire portfolio. The report calculates VaR at the subportfolio level and aggregates it at the currency and portfolio levels. On Demand VaR is also available for What-If portfolios. Hold your mouse over the column names inside the report for more information.

To use the On Demand VaR report

1. From the Risk Navigator main window, select the VaR tab.

2. Select the VaR Scenario:

- Historical - Uses past data to estimate price.

- Monte Carlo - Implements a model for price estimation.

3. Specify the confidence level.

Note: 100% is only available in the Historical scenario.

4. Specify the time horizon in days.