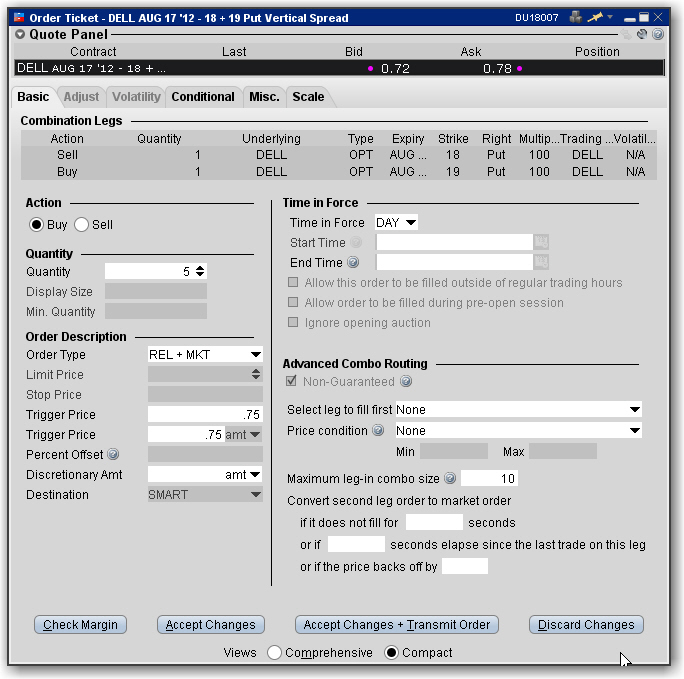

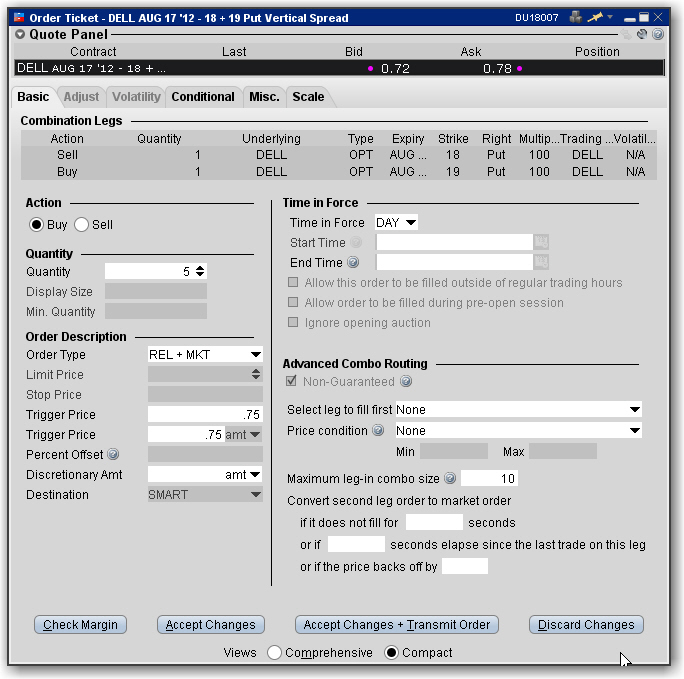

To control routing for large-volume, Smart-routed combination orders, use the Advanced Combo Routing features on the Basic tab of the Order Ticket. Define advanced combo routing for both guaranteed and non-guaranteed combination orders routed to Smart. Selections displayed are based on the combo composition and order type.

To use advanced combo routing

Based on the combo composition and the Order Type, the Advanced Combo Routing selections are displayed. You can monitor the progress of the combo order by holding your mouse over the Status field of the order line.

| Field Name | Description |

|---|---|

| Order Type | Choose from the basic order types as well as: Relative + Market, Limit + Market, Trailing Relative + Market and Trailing Limit + Market. |

| Select leg to fill first |

For orders that are being legged-in, the chance exists that only the first leg of the combo will fill and you will be left with one unexecuted leg. Use this field to specify which leg is submitted and potentially filled first. Use the dropdown list to pick. |

|

Maximum leg-in combo size: |

The order is submitted in pieces, or segments. This is the maximum size of each segment. |

|

Do not start next leg-in if previous leg-in did not finish: |

Specify whether or not the system should attempt to fill the next segment before the current segment fills. |

| Convert second leg order to market order if... | These settings allow you to specify when (if ever) the second leg should be changed to a market order to fill right away, in cases where the first leg fills and the second leg does not and ends up sitting as a non-marketable limit order at the exchange, |

| ...or if the price backs off by... | Provides a way to specify a stop-loss to fill the unexecuted leg of a combo by changing the leg to a market order if the price backs off by the specified amount. |

| Discretionary Amt | In cases where one leg fills and the other doesn't, the discretionary amount indicates how much you are willing to pay to fill the combo. |