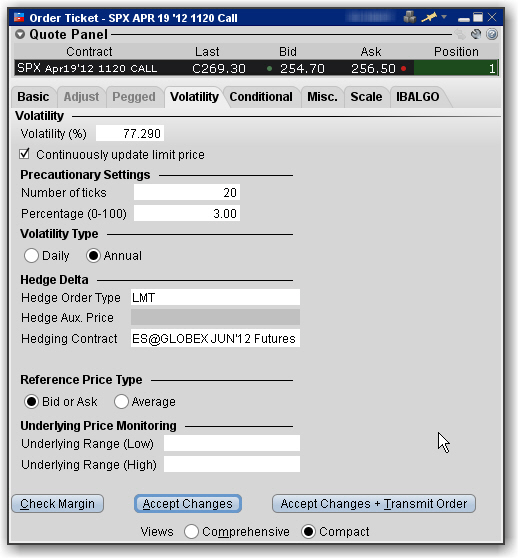

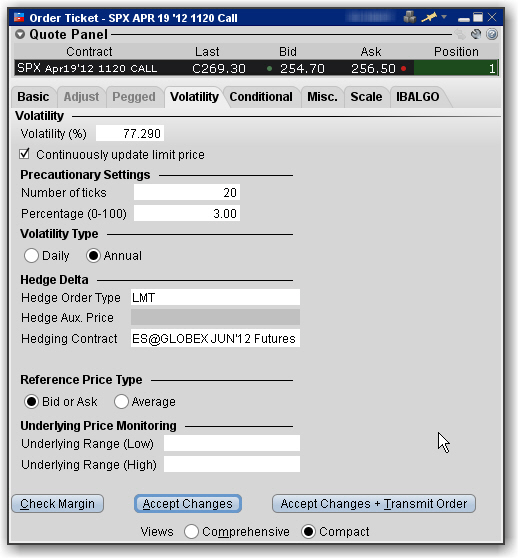

The Volatility order type lets you create option orders where the limit price is calculated as a function of an option volatility that you can modify. If you did not create the order from the VolatilityTrader, you can activate the Volatility tab by selecting VOL as the order type on the Basic tab. If you have attached a delta hedge order from the trading window, you can view the order parameters on the Hedging tab.

To remove tabs and view all fields on a single large page, select the Comprehensive view.

|

Field |

Description |

|

Volatility |

Displays the volatility used to calculate a limit price for the option. The value shown in the Imp Vol field is calculated via the Model Navigator. |

|

When checked, the option price is automatically updated as the underlying stock price moves. |

|

|

Set these price cap “double-checks” as a precaution to ensure your order price remains within an acceptable distance from the market. |

|

|

Elect to view daily or annual volatility. |

|

|

Select a Hedge Order Type. An order will be submitted against the executed option trade to maintain a delta neutral position. For index options, you can define the Hedging, or reference, contract. If you have modified the reference contract in the Model Navigator, the modified contract will be used as the new default reference contract for the order. For a Limit delta hedge order, a snapshot of the stock bid/ask price is taken at the time the parent order fills, and the best available price is used as the limit price (best ask for a buy and best bid for a sell). |

|

|

Use the Hedge Auxiliary Price field to set an auxiliary price for orders that require one, such as the offset for a Relative order. |

|

|

Bid or Ask - If selected, use the NBB (bid) when buying a call or selling a put and the NBO (ask) when selling a call or buying a put. Average - uses average of the best Bid and Ask. This price is also used to compute the limit price sent to an exchange (whether or not Continuous Update is selected), and for underlying range price monitoring |

|

|

Select a futures contract to use in calculating the index value. The order price is then derived from this index value. |

|

|

Underlying Price Monitoring |

Underlying Range (Low) - enter a low end acceptable stock price relative to the selected option order. If the price of the underlying instrument falls BELOW the lower stock range price, the option order will be cancelled. Merely touching the price does not cancel the order. Underlying Range (High) - enter a high end acceptable stock price relative to the selected option order. If the price of the underlying instrument rises ABOVE the upper stock range price, the option order will be cancelled. Merely touching the watermark does not cancel the order. |