Option Strategy Lab

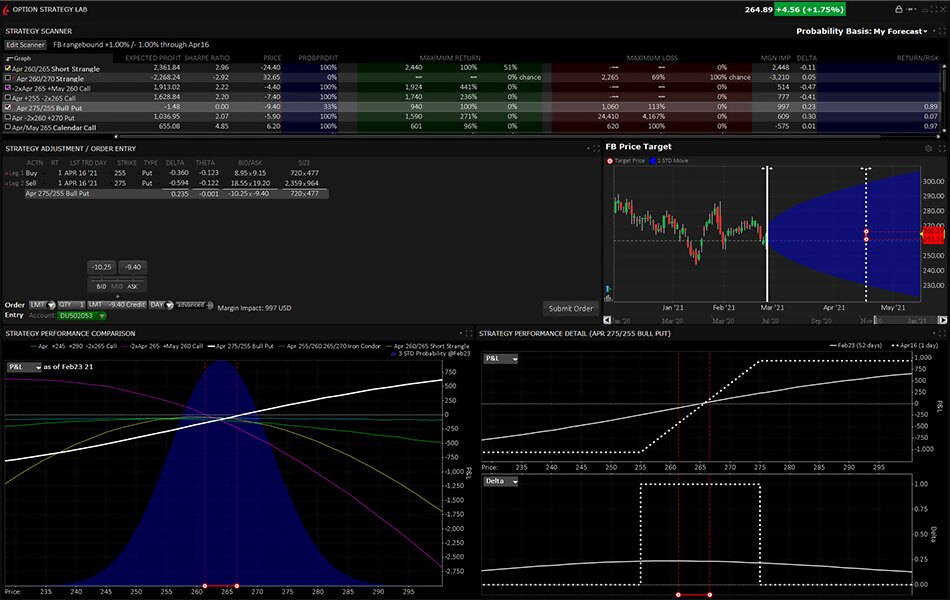

Create and submit simple and complex multi-leg option orders that are based on your price or volatility forecast using the Option Strategy Lab.

Option Strategy Lab offers traders the following benefits:

- Enter your own price or volatility forecast on an underlying to generate a list of strategies.

- Filter results by premium, delta, strike and/or expiry.

- For each strategy, see the potential profit and loss and risk/return ratio in the scanner results.

- Compare the P&L of up to five strategies at one time in the Performance Comparison chart.

- See the P&L performance of the selected strategy up close in the Performance Detail chart.

- Modify leg details and order parameters and submit an order directly from the lab.

For details on using the Option Strategy Lab, see the TWS Users' Guide.