You can set Alarms in Risk Navigator that trigger the creation of a pre-defined Option Portfolio order. You must submit the order manually.

Available measures against which you can set alarms include Delta, Futures Delta, Gamma, Delta Dollars, Gamma Dollars, Vega and Theta. Note that these are "position" values (indicated by capitalization of the first letter). You can set alarms at the position level or at the "All Underlying" level.

To set up an alarm, right-click the contract and select Set Alarm.

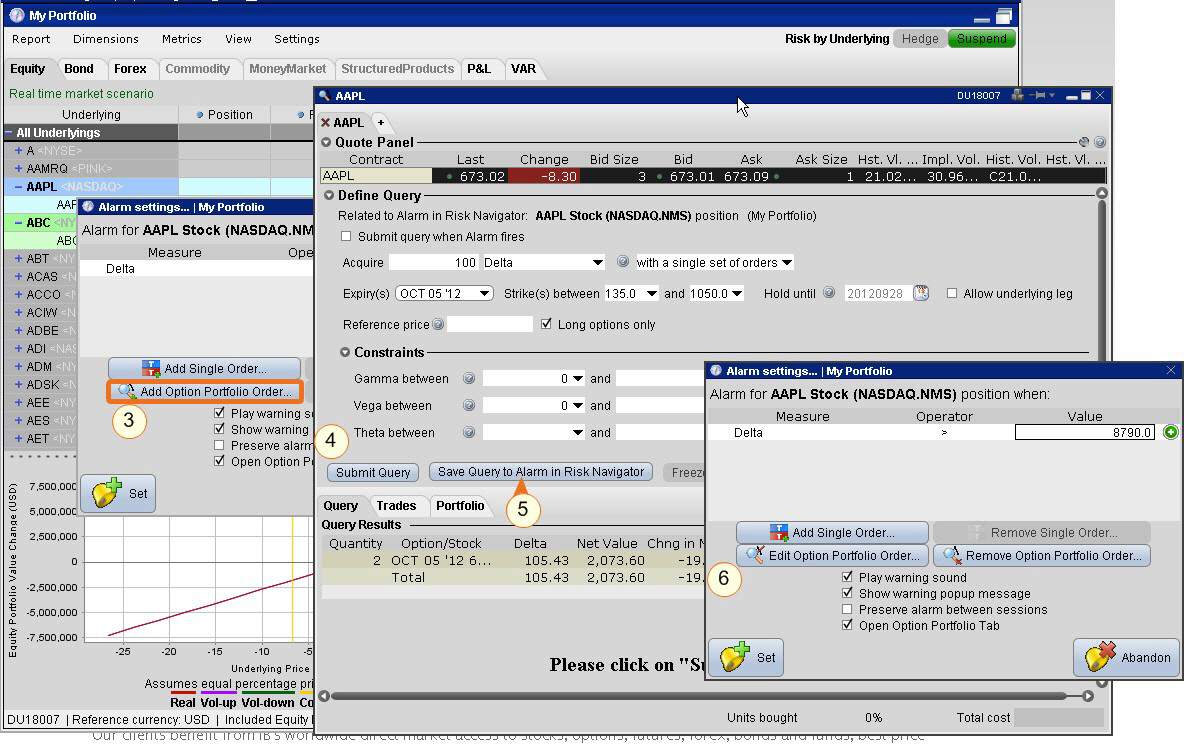

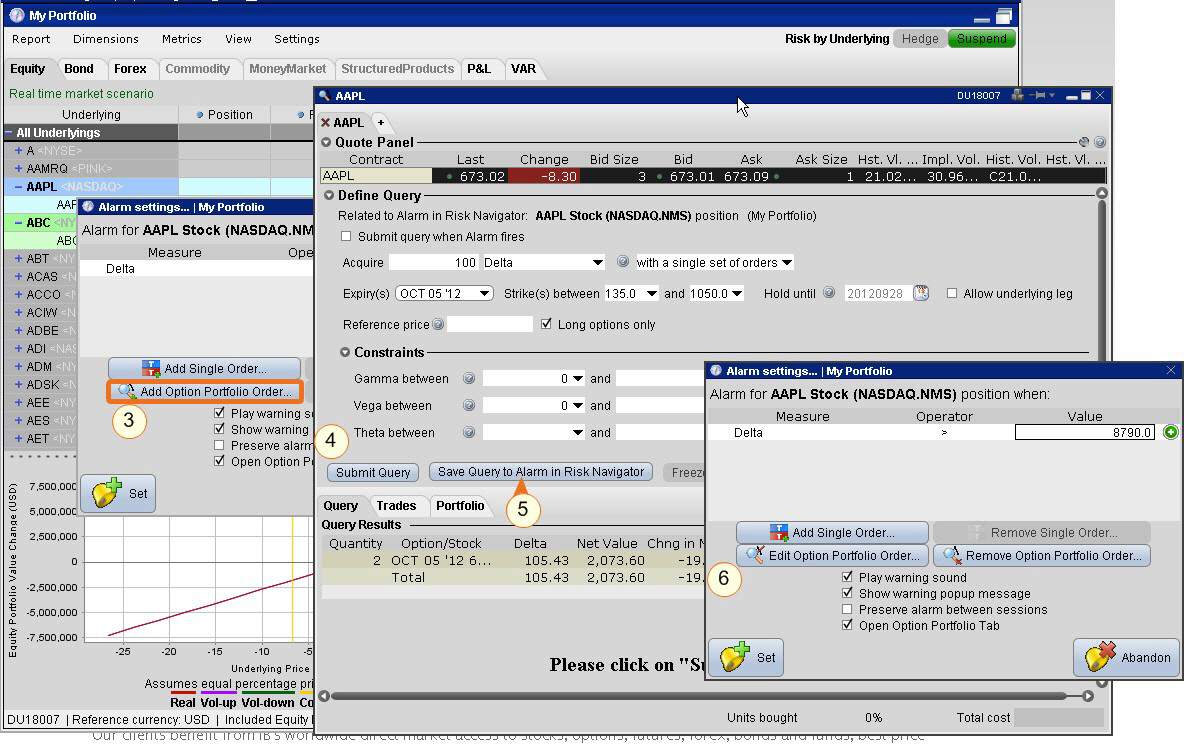

To trigger an Option Portfolio order from a Risk Navigator alarm

1. Right-click a contract and select Set Alarm.

2. Define the measure, select the operator, specify the value.

3. Click Add Option Portfolio Order to open the Option Portfolio tool.

4. Specify the criteria and run the Option Portfolio query.

5. Click Save Query to Alarm in Risk Navigator to have the order created when the alarm triggers.

6. Click Set to set the alarm.

When the alarm triggers, the Option Portfolio order will be displayed and you can transmit the order.