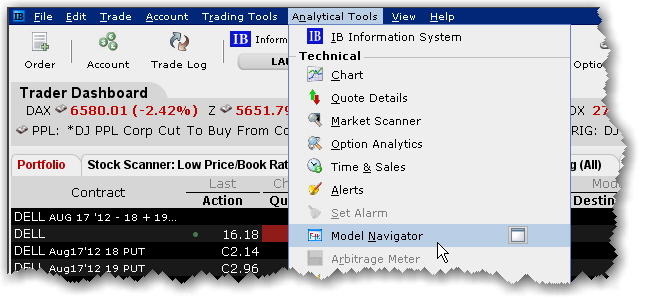

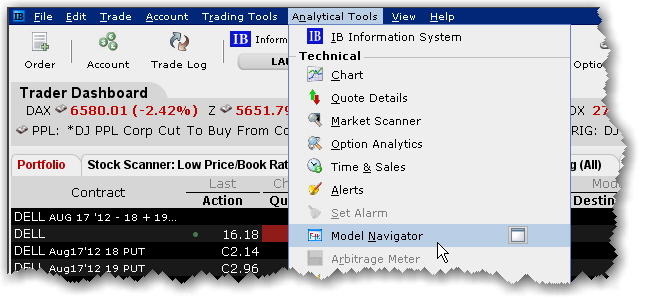

Price/Risk Analytics uses current market data along with interest and dividend values to calculate implied volatilities and option model prices. Use the Model Navigator to modify pricing assumptions and recalculate the model price.

Note: Option model computation requires market data for both the option and its underlying. In the case of index options, the market data for the futures reference contract is also required.

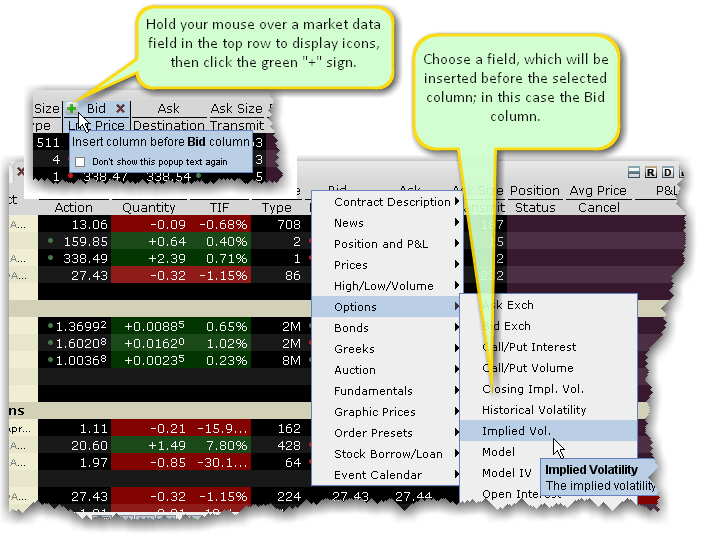

To display Model or Imp Vol fields on a Quote Monitor

The Imp Vol and Model fields display on the page, and all options contracts on the page now require a model calculation and will appear in the Model Navigator Contract Description pane. The implied volatility calculation is non-linear and may not converge for low vega options. In such cases, the Model Navigator will not provide an implied volatility estimate.

The Model Navigator window comprises three main sections: the Contract Description Pane which shows all available options in an expandable tree, the Volatility Model Pane which displays the volatility curve plots, and the Volatility Curve Table table which lists associated strike prices and implied volatilities.