Margin Trading

What is Margin Trading?

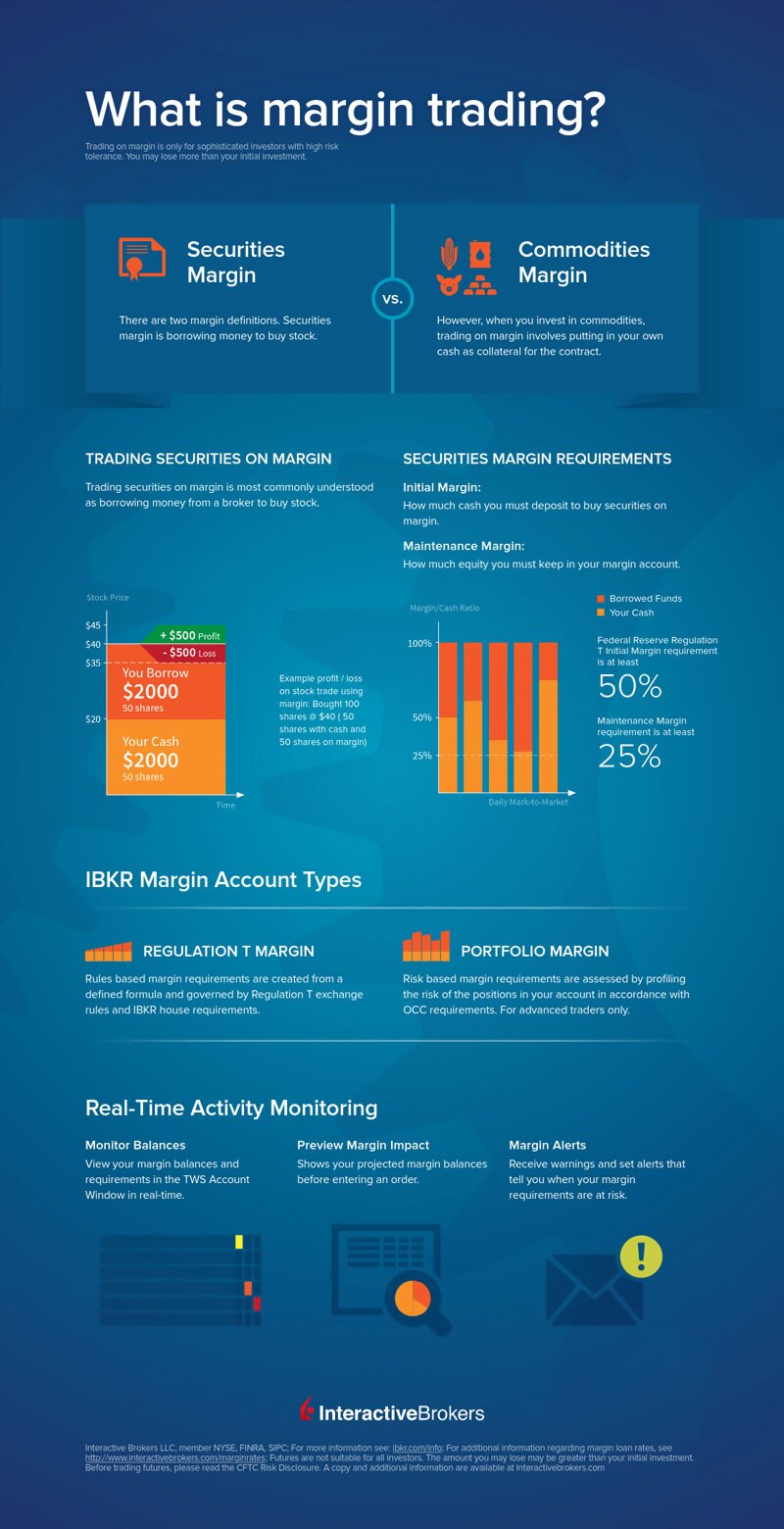

There are two margin definitions. The term Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your own cash as collateral for the contract.

View InfographicBenefits of a Margin Trading Account

Use the cash or securities in your brokerage account as leverage to increase your buying power.

Get the lowest market margin loan interest rates of any broker.1

Diversify trading strategies with short selling, options and futures contracts, or currency trading.

Borrow against a margin account at any time and repay the loan on your own schedule.

Understand the Risks of Margin Trading

Margin borrowing is only for experienced investors with high risk tolerance.

You may lose more than your initial investment.

Before trading on margin, understand the following risks

- Trading losses may be greater than the value of the initial investment

- Leveraged investments create a greater potential risk of loss

- Additional costs from margin interest charges

- Potential margin calls or liquidation of securities

How Trading Securities on Margin Works

Rules-based vs. Risk-based Margin

Margin models determine the type of brokerage accounts you open and the type of financial instruments you may trade. Trading on margin uses two key methodologies: rules-based and risk-based margin.

- In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product. This is the more common type of margin strategy used by securities traders.

- In risk-based margin systems, margin calculations are based on the risk inherent in your trading portfolio. The positions in your account are evaluated, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin requirements.

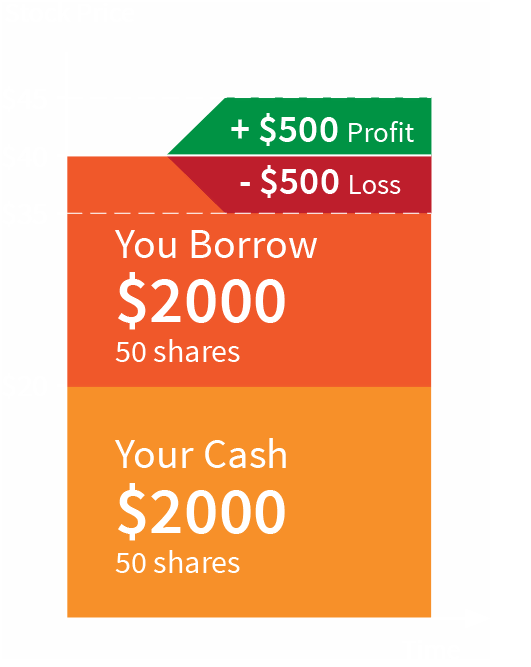

shares @ $40 (50 shares with cash and 50 shares on margin)

Margin Education Course on Traders' Academy

Introduction to Margin Trading

This course is designed to help investors understand margin basics, including different types of margin accounts, margining methods, and margin requirements, plus how to monitor margin on both Trader Workstation (TWS) and IBKR Mobile.

Trading on margin is only for sophisticated traders. You may lose more than your initial investment.

- Introduction to Margin

- Monitoring Margin in TWS

- Looking at Margin on IBKR Mobile

Start trading and investing like a professional today!

Open AccountDisclosures

- According to BrokerChooser's 2025 broker review: Read the full article Interactive Brokers Review 2025. "Interactive Brokers has low trading fees and the best margin rates in the industry."