PortfolioAnalyst Features

PORTFOLIOANALYST

Smart Features for Sophisticated Investors

PortfolioAnalyst’s features help you develop an integrated investment and financial management plan.

Free Standalone PortfolioAnalyst

for Non-Clients

IBKR Broker Account

with Integrated PortfolioAnalyst

Access to Your Broker Account

with Integrated PortfolioAnalyst

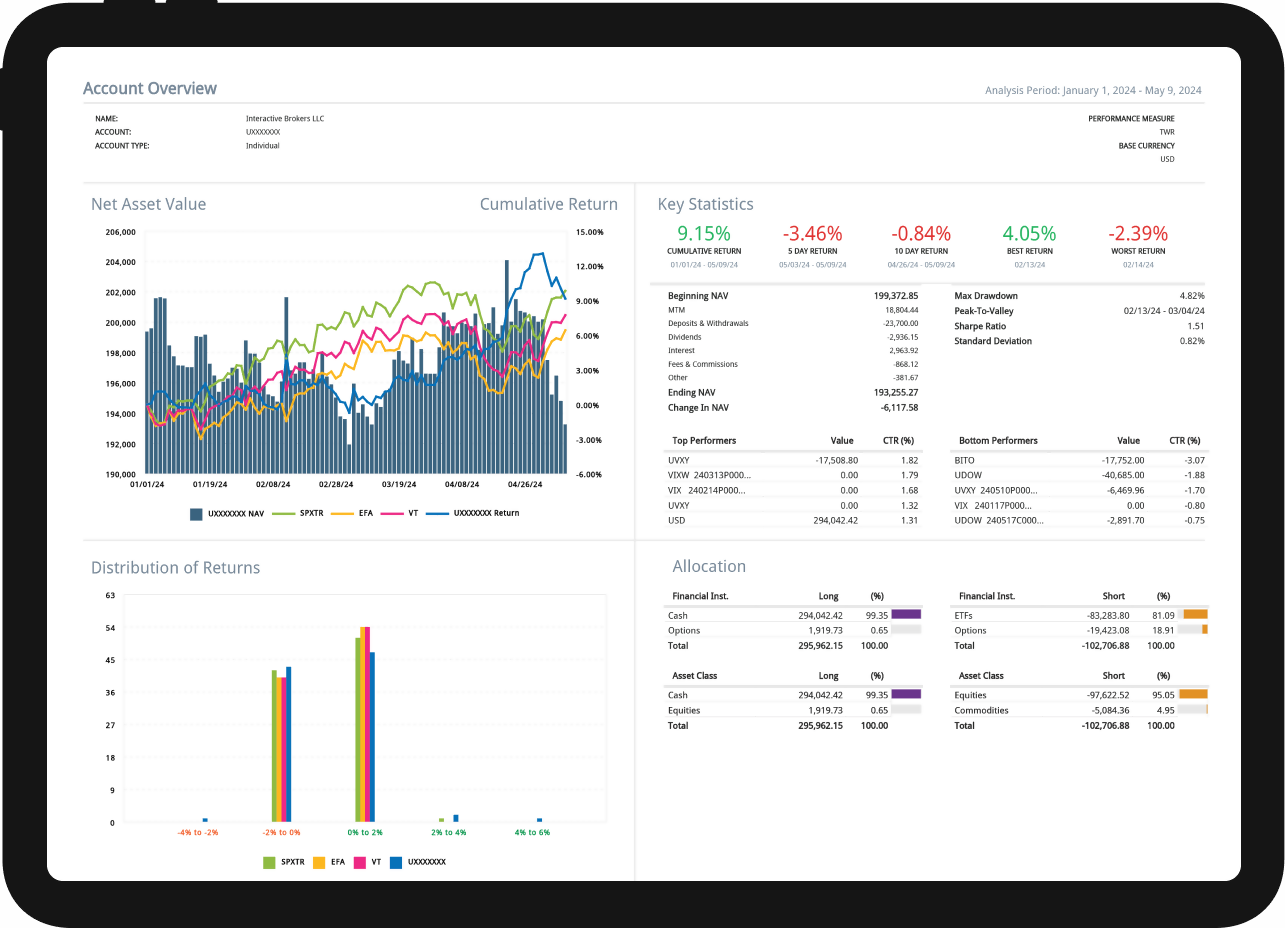

PortfolioAnalyst Dashboard

View the performance of linked brokerage, checking, savings, incentive plan or credit card accounts in a single view and use widgets to create a view tailored to your specific needs.

Professional Content

and Rich Reporting

PortfolioAnalyst includes robust reporting with an extensive library of default reports, such as portfolio holdings, allocation, performance, activity and other metrics to help you analyze your portfolio. Access up to 35 performance and measurement factors, including time period performance statistics, performance attribution vs. benchmark, projected income, and risk measures, now including Value at Risk, which calculates the expected loss of a portfolio during a specific time horizon.

Tailor reports for each client with little effort, creating custom benchmarks, synopses, aliases and cover pages. Own the client experience simply by uploading your logo, which quickly appears on the PortfolioAnalyst portal, client reports, emails, updates and disclosures.

Planning Tools

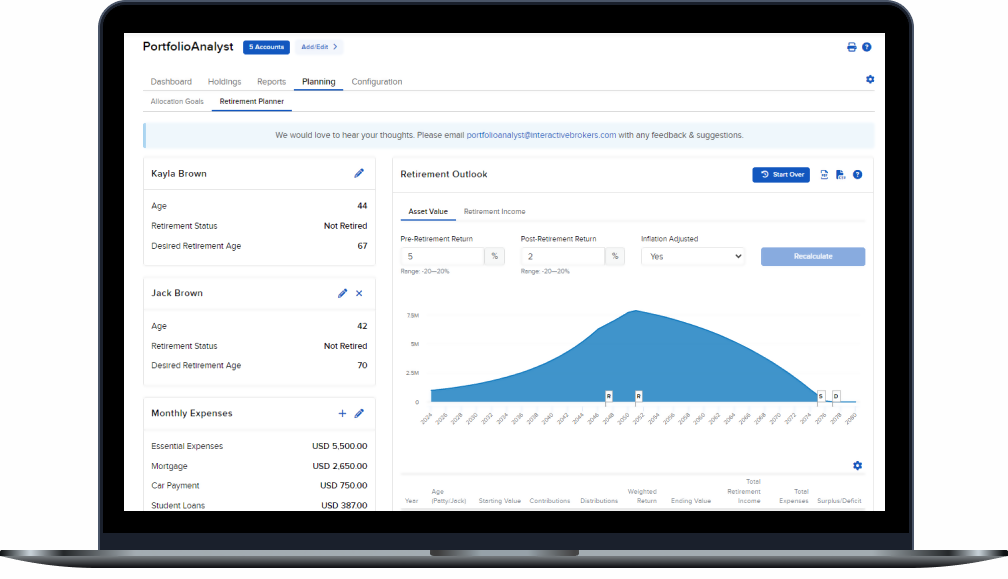

PortfolioAnalyst transforms portfolio data into powerful analytics to help you stay on track. Planning tools such as Allocation Goals allows users to track a portfolio's allocations and the Retirement Planner helps you chart your path to financial independence.

Allocation Goals

Create allocation goals and track performance against goals to help ensure you are on track to achieving your investment objectives. View your current vs. target asset and sub-asset class allocations for seamless portfolio rebalancing. Once configured, you can run the Allocation Goals report to identify over and underweighted asset and sub-asset classes vs. the configured goal.

Retirement Planner

Better understand your retirement outlook by creating a plan that considers your personal retirement preferences, current and future employment expectations, any potential additional monthly retirement income sources, your current monthly expenses, and general market performance assumptions.

Budgeting

Create annual and monthly budgets that use transaction data from your brokerage, bank and credit card accounts to track and categorize spending. The tool provides a Budget Overview, available in both a table and chart format and Spending Insight, which shows your current spending by category and sub-category, as well as upcoming transactions. You can also use the tool to track progress towards Life Events, gain insight on your net worth and monitor transactions.

Consolidate, Track, and Analyze

Consolidate, track and analyze your complete financial picture by using PortfolioAnalyst to link your brokerage, checking, savings, credit cards, annuities, incentive plans, mortgages, student loans and more into a single view.

Understand your current financial state, plan for the future, better understand risks vs. returns and analyze your financial picture with powerful analytics and reporting features.

Consolidated Reporting

Better understand the performance of a single account, group of related accounts or all accounts by running a consolidated report to analyze portfolios and share the consolidated report with a client.

PortfolioAnalyst helps your clients understand what makes you different. Our presentation-ready reports put focused data at your fingertips and are designed to help you shape discussions around each client's interests. When applicable, PortfolioAnalyst simplifies the process of demonstrating your bespoke portfolios outperform benchmark returns year-over-year.

Better Understand Your Portfolio's Alignment with Investment Themes

Better understand your complete portfolio's exposure with the Investment Themes widget and report. Themes are automatically sorted by strength and then weight, and you can drill down to see underlying companies and rankings, track unrealized P&L by company, and view unmapped positions separately for complete portfolio transparency.

Detailed Activity Tracking

See a detailed break down of your deposits and withdrawals, interest, fees, dividends and corporate actions, along with a daily trade summary for each included account or view an accounts Key Statistics to determine the cause of any net asset value (NAV) fluctuations.

Custom Benchmarking

PortfolioAnalyst lets you create custom benchmarks to measure your portfolio’s performance. Select from more than 300 standard industry benchmarks and apply your own custom weighting to create a custom benchmark.

Whitebranding

White brand statements, client registration and other informational materials with your own organization’s identity, including performance reports created by PortfolioAnalyst.

External Accounts

Understand your complete financial picture by using PortfolioAnalyst to link your brokerage, checking, savings, credit cards, annuities, incentive plans, mortgages, student loans and more into a single view.

View your complete financial picture, plan for the future, better understand risks vs. returns and analyze your entire portfolio with powerful analytics and reporting features.

Safeguarding Confidential

Client Data

As a leading online broker, Interactive Brokers understands and values the trust our clients place in us to safeguard confidential client data. We use trusted, industry standard security measures when linking your account with PortfolioAnalyst, and maintain strict operational guidelines regarding access to your data:

- Usernames and passwords are encrypted with Triple Data Encryption Standards (3DES) and nCipher hardware encryption. Data in transit is encrypted using TLS1.2 protocol.

- You can authenticate directly on the websites of institutions that support Open Authorization (OAuth).

- IBKR will never sell or trade your personal information with outside marketing firms.

- Employee access to the personal, non-public information you share with us is restricted, and employees are prohibited from using or disclosing this information.

PortfolioAnalyst is Free to Use

Open a PortfolioAnalyst Account Institutional Clients: Request a Demo

Interested in an Interactive Brokers Brokerage Account?

Interactive Brokers (Nasdaq: IBKR) is an automated global electronic broker that serves individual investors, hedge funds, proprietary trading groups, registered investment advisors and introducing brokers.

Our four-decade focus on technology and automation allows us to provide our clients with a sophisticated, global trading platform with the lowest costs for managing investments. IBKR clients enjoy access to stocks, options, futures, currencies, bonds, funds and more on over 160 markets in 37 countries.

Already a Client?

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial. Options are not suitable for all investors. For more information, read the "Characteristics and Risks of Standardized Options".

Your capital is at risk and your losses may exceed the value of your original investment.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority. FCA Reference Number 208159.

Cryptoassets are unregulated in the UK. Interactive Brokers (U.K) Limited ("IBUK") is registered with the Financial Conduct Authority as a cryptoassets firm under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017.

Interactive Brokers LLC is regulated by the US SEC and CFTC and is a member of the SIPC (www.sipc.org) compensation scheme; products are only covered by the UK FSCS in limited circumstances.

Before trading, clients must read the relevant risk disclosure statements on our IBUK Services Guide – Investing with IBKR page.

For a list of IBG memberships worldwide, see our exchange listings.