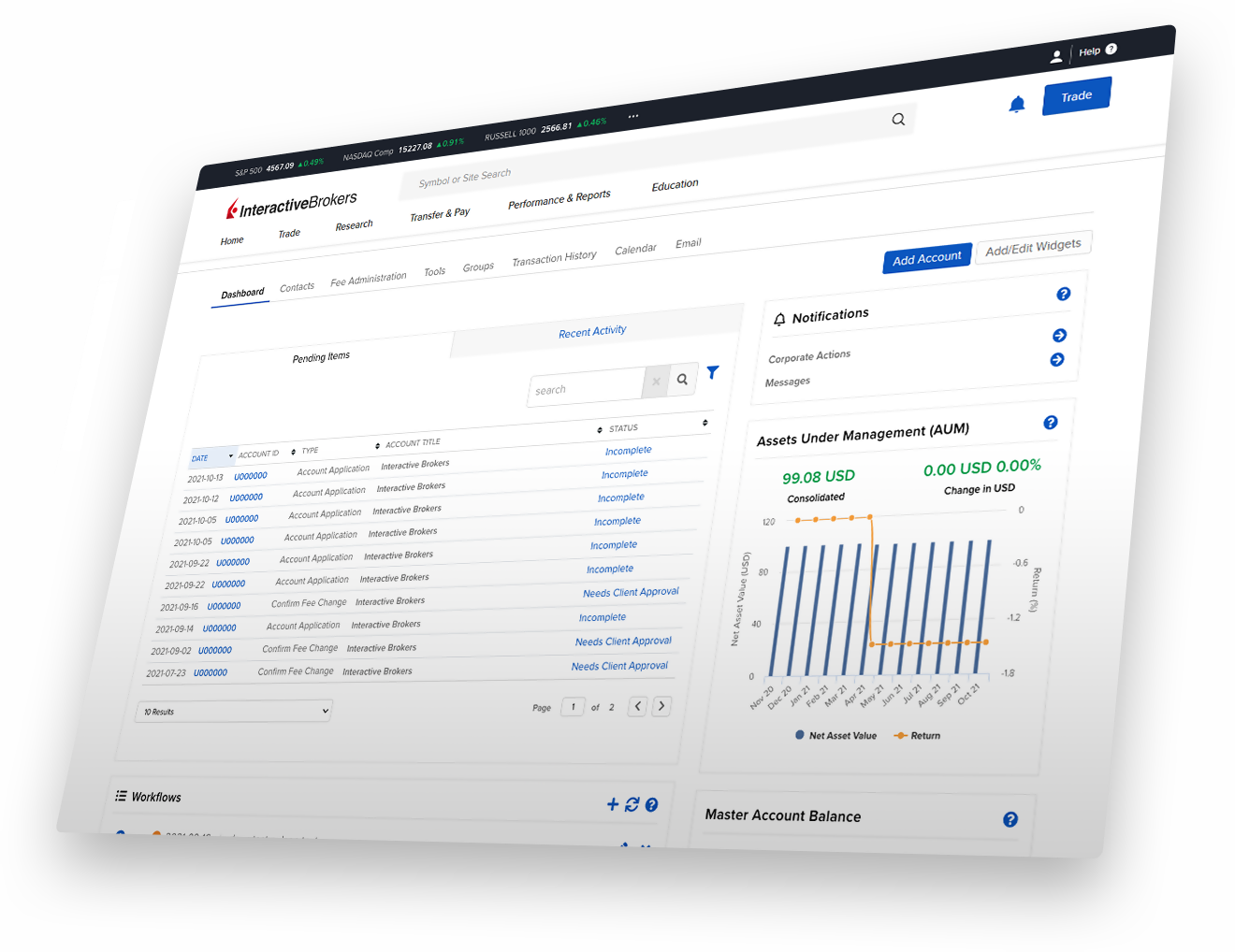

Broker Portal

Broker Portal

Our turnkey CRM, custody, account management, trading and reporting solution to help you build competitive advantage and efficiently manage your business at lower cost.

The Interactive Brokers Advantage

- Integrated suite of advanced CRM tools for managing the client acquisition and relationship lifecycle

- Powerful, award-winning trading platforms for trading stocks, options, futures, currencies, bonds, funds and more, on over 160 markets from a single unified master account, and trading cryptocurrencies from the same platform

- Digital Account Management tools to administer accounts and coordinate funding, plus automated and flexible client billing

- PortfolioAnalyst®, a tool to consolidate your clients’ entire portfolios

Client Relationship Management (CRM)

At the heart of Broker Portal is an integrated suite of CRM tools for managing the complete client relationship lifecycle.

- Drive client engagement via emails, notes, agendas, calendars and more, including account-opening invitations to prospects.

- Store, view and update information about all of your contacts, both clients and prospects.

- Set fee structures and use templates to automate and simplify administration, invoicing and queries.

- Consolidate client financial information from any institution alongside IBKR accounts.

- Place your logo on statements, performance reports, communications and more, with links to your website.

- Use PortfolioAnalyst®, a full-featured portfolio management tool, to quickly and easily consolidate financial information, run powerful analytics, allocate ETF and fund holdings by multiple segmentation strategies, run custom reports and more.

Client Onboarding

and Account Management

Use our Digital Account Management tools to manage applications, administer accounts and coordinate account funding.

- Choose among multiple options for adding and migrating clients to IBKR, including a mass upload feature and support for customized client applications.

- Use the information you have about prospects in email invitations to complete applications on their behalf.

- Link client accounts under a single username and password, and delegate user access rights by function and client account.

- Establish and implement client preferences related to socially responsible investing.

- Transfer funds and positions, check transaction status and history, and submit withdrawals for both master and client accounts.

- Protect client accounts with our Secure Login System’s Two-Factor Authentication (2FA) as an extra layer of security.

- More easily complete regulator or internal auditing with a bulk download tool that allows for straightforward retrieval of client documents.

Learn About Account Management

Trade Your Account

Trading Platforms

A username and password provides access to our award-winning platforms that are powerful enough for professionals, but designed for everyone.

| Trading Platforms by Trading Experience | ||||||

|---|---|---|---|---|---|---|

| Trading Platforms by Trading Experience | Beginner | Intermediate | Advanced | |||

|

Client Portal

Web

|

||||||

|

IBKR Mobile

Mobile

|

||||||

|

Trader Workstation (TWS)*

Desktop

|

||||||

|

IBKR GlobalTrader

Mobile

|

||||||

|

IBKR APIs*

Desktop

|

||||||

All platforms are available for broker's clients.

* Platforms available for broker master accounts.

IBKR GlobalTrader

Broker clients can easily trade global stocks, options and ETFs from a simplified interface from a mobile device.

Please note that Clients of Introducing Brokers can download the iOS & Android Mobile Apps, however, Brokers do not have direct access to this tool.

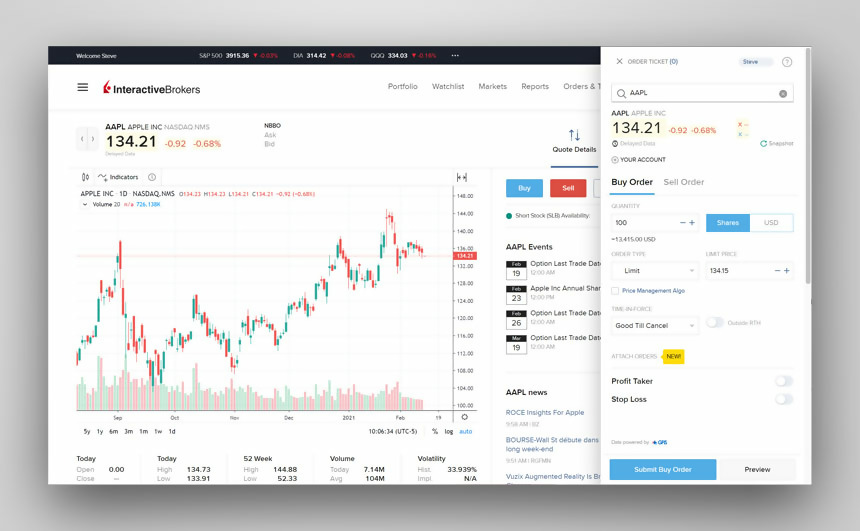

Portal

Brokers use Portal to manage client accounts. Clients use Portal to check quotes and place trades, see account balances, reporting and more.

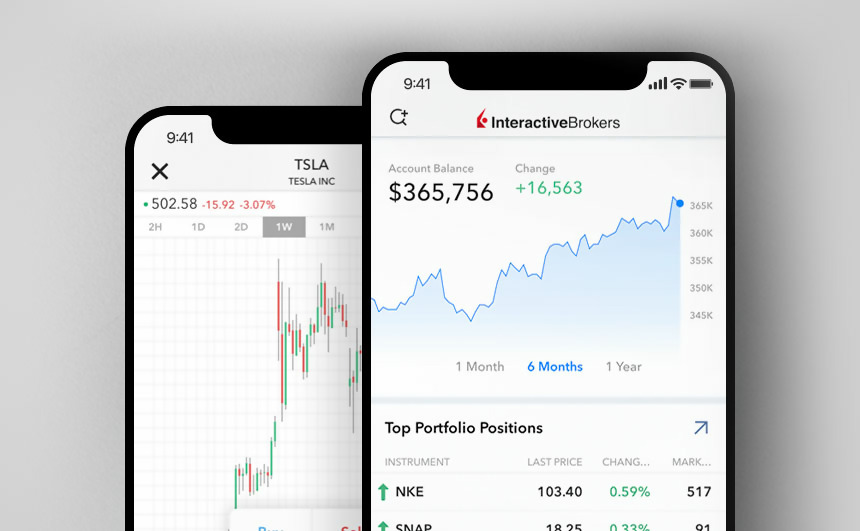

IBKR Mobile

Broker clients can easily trade and monitor their account on-the-go from an iOS or Android device (tablet or smartphone).

Please note that Clients of Introducing Brokers can download the iOS & Android Mobile Apps, however, Brokers do not have direct access to this tool.

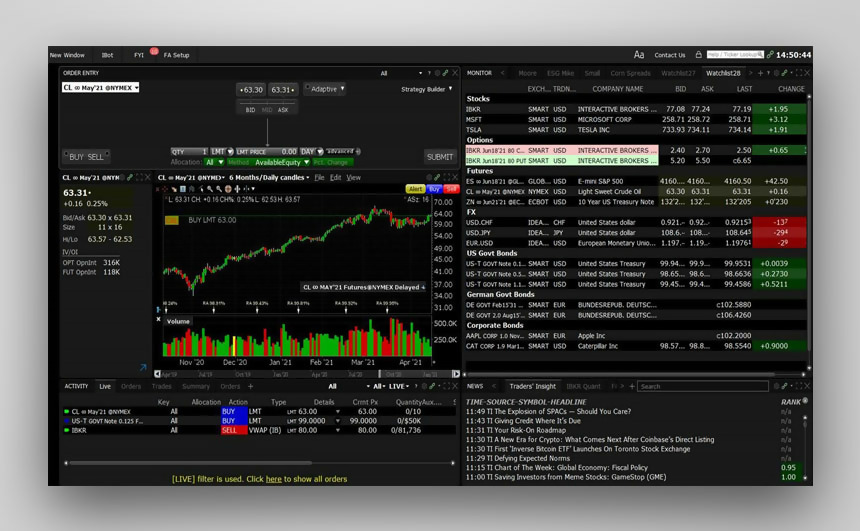

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility.

IBKR API

From easy-to-use Excel API to IBKR’s industrial strength FIX API, IBKR offers APIs for every experience level.

Advanced Investment and Portfolio Tools

Invest globally in stocks, options, futures, currencies, bonds, funds and more from a single unified platform. Support account funding and trading in multiple currencies, and trade U.S. stocks, Canadian stocks and European stocks in fractions.

Learn About Advisor Tools

Performance & Statements

Performance & Statements

The Performance & Statements menu in Broker Portal provides access to PortfolioAnalyst®, standard Statements, Flex Queries, Tax Documents, a suite of Broker specific reports and more.

IB provides a variety of highly customized reports in various formats which can be accessed from Portal > Performance Reports. In addition to these reports, we also provide Introducing Brokers with the following Broker Exception Reports:

- Incoming Stock Transfer Report: A list of any securities transfers that were transferred into a client account from an external source.

- Small and Micro-Cap Trade Blotter: A list of trades done by IBroker client accounts where the share price was less than USD 5.00.

- Customer Information Change Report: A list of all informational changes the clients of an IBroker made on the previous day, including address changes.

- Top 40 Accounts: A list of top 40 IBroker clients with the largest PNL gains and commissions.

*Note this report is not currently generating and is being re-written - Cashier Transaction Blotter: A list of deposits and withdrawals for the IBroker client accounts.

- Foreign Bank Certification Review Report: A list of any client accounts that have declared themselves to be foreign banks.

- OFAC and World Check Reports: This includes checks against the global sources from OFAC and World Check, as well as OFAC and World Check Reports that have occurred and were processed in the last 21 days for each open cleared sub account of the IBroker master account.

- Account Information and CIP Opening Document Reports: The account information reports are accounts generated for any newly approved client of the IBroker that have been approved between the previous trading day and the day the report is run for. They do not cover existing client accounts that were approved before the IBroker signed up for the FINRA 4311 reports. Reports include information such as name, address, org info, etc. They include the basic account information, the entities on the account, TWS users with associated entities, and World Check/Equifax Checks if applicable. Opening CIP documents used for AML purposes are provided on the same schedule as the account information reports. These CIP documents if required for an account, may include copies of a driver’s license, passport, utility bills etc.

- Politically Exposed Clients: These reports show any sub accounts of the IBroker master account that are marked as PEP as determined by Compliance. Typically, if an account has an OFAC or World Check positive match for a PEP, Compliance will mark the account as such.

Support Resources

Frequently Asked Questions

Looking for an answer? Browse our extensive inventory of frequently asked questions.

IBKR Campus

Learn about the tools, markets and technology available to you with our Advisors curriculum. Stay on top of market events at Traders Insight, learn about programming at the Quant Blog, subscribe to our Podcast channel for interviews and audio articles covering the world of finance, or sign up for a complimentary webinar.

Global Product Offering

Invest globally in stocks, options, futures, currencies, bonds and funds from a single unified platform.

Margin Trading

IBKR offers margin rates from USD 4.83% - 5.83%, the lowest margin loan interest rates of any broker, according to the StockBrokers.com Online Broker Survey 2023 Read the full article.

Support for Institutions

Browse our support page for instructional videos, user guides, release notes and information on connecting with us.