Contracts for Difference (CFDs)

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62.0% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Products

Trade Contract for Difference (CFDs)

The IBKR Advantage

- Transparent, low commissions and financing rates

- Trade CFD Shares, Index, Metals and Forex virtually around the clock

- Margin requirements generally more favorable than those of shares

IB Index and Metals CFDs

Gain broad market exposure more easily than with many other financial products. Additional benefits include:

Flexible Exposure to Global Markets

Index CFDs are available for all major equity market indices and precious metals (London Gold and Silver). Most equity indices and metals are tradable 23 hours. Equity indices can be traded in lots as small as 1X the index level. Unlike the related futures, Index CFDs do not expire, saving rollover related costs and risks.

Transparent, Low Commissions and Financing Rates

Depending on the index, commission rates are only 0.005% - 0.01%. Commissions are only 0.015% for Gold and 0.03% for Silver. Overnight financing rates are just benchmark +/-1.5%. IBKR does not widen the spread of the related future or spot underlying like some other brokers. The Index CFD quotes accurately represent the spreads and price movements of the related future* or spot price, and there are no requotes.

Margin Efficiency

Index CFDs are margined at the same low rates as the related future, adjusted for contract size. Retail clients are subject to minimum regulatory margins of 5% or 10% depending on the index or metal.

IBKR Index CFDs FAQs

FAQs: IBKR Index CFDs

*IB hedges all index CFD trades, and does not operate a dealing desk. Fills cannot be guaranteed in extreme markets.

Forex CFDs

Gain exposure to currencies around the clock more easily than with many other financial products. Additional benefits include:

Direct Access to Interbank Quotes

Real-time prices from 19 of the world's largest FX dealing banks, plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account.

ECN-Like Market Structure

Our order book allows you to set orders away from or between the markets. Trade with other IBKR clients, as well as with the liquidity-providing banks.

IBKR Forex CFDs FAQs

FAQ: IBKR Forex CFDs

Automatic Overnight Position Rolls

For positions held overnight, IBKR applies a straightforward interest credit or charge based on the difference in the benchmark rates for the two currencies and a low IB spread.

FX Trader

Trade Forex CFDs in our optimized FXTrader, which includes real-time streaming quotes, up and down indicators, trading volumes, pending trades, executions, positions, and average price plus P&L.

Powerful CFD Trading Tools

FXTrader

The FXTrader provides an optimized trading interface with IBKR-designed tools to trade the currency markets.

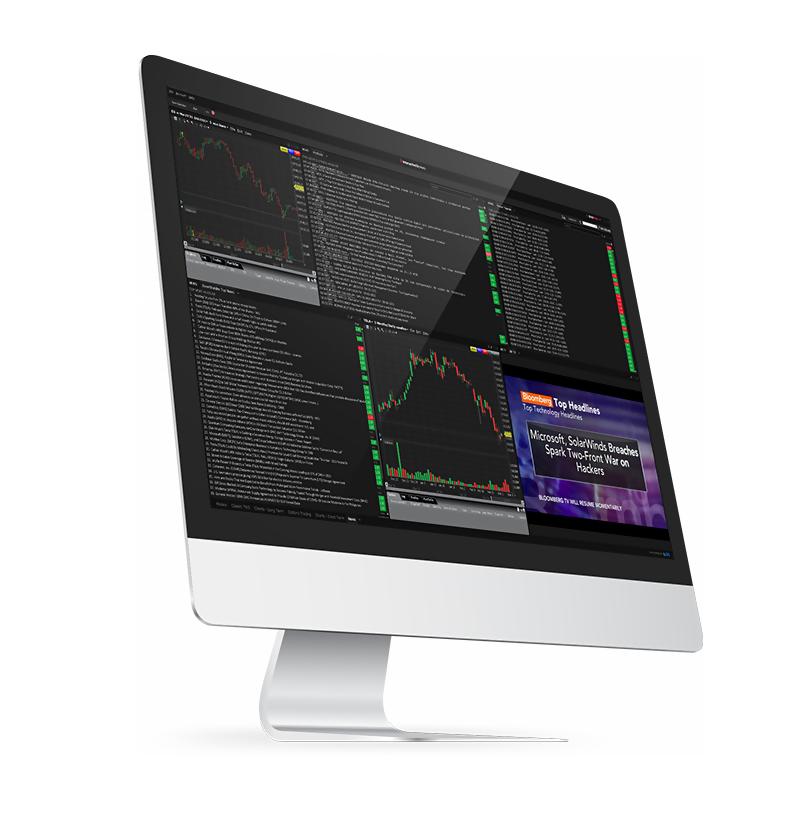

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility.

IBKR Mobile

Easily trade and monitor your IBKR account on-the-go from your iOS or Android device (tablet or smartphone).